Wednesday, July 31, 2019

Tuesday, July 30, 2019

Last date to furnish FORM GST CMP-08 extended till 31.08.2019

Last date to furnish FORM GST CMP-08 extended till 31.08.2019

Government of India

Ministry of Finance

(Department of Revenue)

Central Board of Indirect Taxes and Customs

Notification No. 35/2019 – Central Tax

New Delhi, the 29th July, 2019

G.S.R…..(E).– In exercise of the powers conferred by section 148 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government, on the recommendations of the Council, hereby makes the following further amendments in the notification of the Government of India in the Ministry of Finance (Department of Revenue), No. 21/2019- Central Tax, dated the 23rd April, 2019, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 322(E), dated the 23rd April, 2019, namely:–

In the said notification, in paragraph 2, in the proviso, for the figures, letters and words “31st day of July, 2019”, the figures, letters and word, “31st day of August, 2019” shall be substituted.

[F. No. 20/06/16/2018-GST (Pt. I)]

(Ruchi Bisht)

Under Secretary to the Government of India

The post Last date to furnish FORM GST CMP-08 extended till 31.08.2019 appeared first on Studycafe.

from Studycafe https://ift.tt/2K4S9j3

DIR-3 KYC : MANDATORY COMPLIANCE FOR DIN HOLDERS

DIR-3 KYC : Mandatory Compliance For Din Holders

(An Analysis Of MCA Circulars, Notification, Laws And Regulation, E-Forms Etc.)

Attention :

MCA (MINISTRY OF CORPORATE AFFAIRS) HAS RECENTLY ISSUED COMPANIES (APPOINTMENT AND QUALIFICATION OF DIRECTORS) THIRD AMENDMENT RULES, 2019 AND THE COMPANIES (REGISTRATION OFFICES AND FEES) FOURTH AMENDMENT RULES, 2019 ON 25TH JULY 2019 ON “DIR-3 KYC”.

As per the notification issued on 25th July 2019 :

1. E- Form DIR-3 KYC is to be filed by an individual who holds DIN and is filing his KYC details for the first time or by the DIN holder who has already filed his KYC once in eform DIR-3 KYC but wants to update his details.]

2. Web service DIR-3-KYC-WEB is to be used by the DIN holder who has submitted DIR-3 KYC eform in the previous financial year and no update is required in his details.

3. Due date for filing the KYC form is 30th September, 2019.

4. Update on Filing the Form: Per day you can only do 10 Web- KYC from one login. Either wait for next day or use another Login.

ABOUT WEB BASED DIR-3 KYC :

1. Filed by the DIN Holder :

a. who has submitted DIR-3 KYC eform in the previous financial year and

b. no update is required in his details.

2. How to file :

a. Go to www.mca.gov.in

b. LOG IN TO YOUR MCA ACCOUNT

c. CLICK ON MCA SERVICES TAB

d. NAVIGATE TO – DIN SERVICES – *DIR 3 KYC WEB*

e. Enter DIN NO. AND SUBMIT

f. GENERATE OTP’s for EMAIL ID & MOBILE NO.

g. ENTER THE OTP’S IN THE RESPECTIVE FIELDS

h. CONFIRM THE DETAILS OF PERSON APPEARING ON SCREEN

i. CLICK SUBMIT

j. GENERATE A ZERO RUPEE CHALLAN

k. CHECK SRN STATUS FOR CONFIRMING THE KYC VERIFICATION.

ABOUT E- FORM DIR-3 KYC :

1. FILED BY AN INDIVIDUAL :

a. who holds DIN and

b. filing his KYC details for the first time or

c. by the DIN holder who has already filed his KYC once in eform DIR-3 KYC but wants to update his details.

ANALYSIS OF MCA RULES AND CIRCULARS :

I. Companies (Appointment and Qualification of Directors) Third Amendment Rules, 2019

Applicable : with effect from 25th July, 2019

Key Highlights :

Changes made under Rule 11(2) and Rule 12A of the Companies (Appointment and Qualification of Directors) Rules, 2014 (Given below under the heading “Governing Laws & Regulations”).

Link : http://www.mca.gov.in/Ministry/pdf/ThirdAmendRules_25072019.pdf

II. The Companies (Registration Offices and Fees) Fourth Amendment Rules, 2019

Applicable : with effect from 25th July, 2019

Key Highlights :

- Fee payable till the 30th September of every Financial Year in respect of E-form DIR-3 KYC or DIR – 3 KYC – WEB through web services, as the case may be, for the immediate preceding Financial Year.

- Fee payable in delayed cases is Rs. INR 5000/-

- Fee payable if the individual failed to file e-form DIR-3 KYC or DIR-3 KYC-WEB through web service, as the case may be, for the immediate previous financial -Year (in delayed case) is . INR 5000/-.

Link : http://www.mca.gov.in/Ministry/pdf/FourthAmedRules_25072019.pdf

III. MCA Notification dated 13.04.2019 :

DIR 3 KYC is Annual Compliance : DIN holders are required to file the DIR-3 KYC form every year, so that they are aware of and confirm the data & information as available in the MCA21 system.

http://www.mca.gov.in/Ministry/pdf/DIR3KYCcompleteMessage_13042019.pdf

IV. As per MCA General Circular NO.07-2019 on DIR-3 KYC. dt. 27.06.2019

1) every person who has already filed DIR-3 KYC will only be required to complete his/her KYC through a simple web-based verification service, with pre-filled data based on the records in the registry, for ease of verification by the person concerned.

2) in case a person wishes to update his mobile no. or e-mail address, he would be required to file e-form DIR-3 KYC, as this facility of updation is not being proposed in the web-based service.

3) in case of updation in any other personal detail, E-form DIR-6 may be filed for updation of the same before completion of KYC through the Web-Based Service.

Link for the same :

http://www.mca.gov.in/Ministry/pdf/GeneralCircular_27062019.pdf

OVERVIEW :

Ministry of Corporate Affairs has issued circular dated 05th July, 2018 on Companies (Appointment and Qualification of Directors) fourth Amendment Rules, 2018 to conduct KYC for all the directors of companies annually through a new E-form DIR-3 KYC. These rules has came into effect from 10th July, 2018.

Link of the Circular : http://icmai.in/upload/Institute/Updates/MCA_12072018.pdf

GOVERNING LAWS & REGULATION :

Rule 12A and Rule 11(2) and 11(3) of the Companies (Appointment and Qualification of Directors) Rules, 2014.

According to these rules :

Rule 12A : “Every individual 5 who holds a Director Identification Number (DIN) as on 31st March of a financial year as per these rules shall, submit e-form DIR-3-KYC for the said financial year to the Central Government on or before 30th, September of immediate next financial year.”

where an individual who has already submitted e-form DIR-3 KYC in relation to any previous financial year, submits web-form DIR-3 KYC-WEB through the web service in relation to any subsequent financial year it shall be deemed to be compliance of the provisions of this rule for the said financial year:

Provided also that in case an individual desires to update his personal mobile number or the e-mail address, as the case may be, he shall update the same by submitting e-form DIR-3 KYC only.

Rule 11(2) : “The Central Government or Regional Director (Northern Region), or any officer authorized by the Central Government or Regional Director (Northern Region) shall, deactivate the Director Identification Number (DIN), of an individual who does not intimate his particulars in e-form DIR-3-KYC 3 or the web service DIR-3-KYC-WEB as the case may be within stipulated time in accordance with rule 12A.”

Rule 11(3) : The de-activated DIN shall be re-activated only after e-form DIR-3-KYC 3 or the web service DIR-3-KYC-WEB as the case may be is filed along with fee as prescribed under Companies (Registration Offices and Fees) Rules, 2014.

Who needs to file DIR-3 KYC ?

- Every Director having DIN or who has been allotted DIN and whose DIN is in ‘Approved’ status.

- Directors having disqualified DIN, also have to comply with the aforesaid requirement.

For Financial year 2019-20 onwards – Every Director who has been allotted DIN on or before the end of the financial year, and whose DIN status is ‘Approved’, would be mandatorily required to file form DIR-3 KYC before 30th April of the immediately next financial year.

Fee for filing e-form DIR-3 KYC or web-form DIR-3 KYC-WEB through the web service under Rule 12A of Companies (Appointment and Qualification of Directors) Rules, 2014:

- As provided in Companies (Registration Offices and Fees) Rules, 2014.

|

i) Fee payable till the 30th April of every —- financial year in respect of e-form DIR-3 KYC as at the 31st March of immediate previous year. |

No fee |

|

ii) Fee payable (in delayed case). |

Rs.5OOO |

Form DIR-3 KYC, if filed within the due date of the respective financial year, no fee is payable. However, if filed after the due date, for DIN status ‘Deactivated due to non-filing of DIR-3 KYC’ a fee of Rs.5000 (Rupees Five Thousand Only) shall be payable.

Documents to us to file your DIR-3 KYC

- Self attested copy of PAN – Mandatory

- Self attested copy of AADHAAR ,

- Self attested copy of Passport

- Self attested copy of Driver’s Licence (if you have)

- Mobile Number (linked with Aadhaar)

- Email ID (Personal)

- Statement, Electricity bill/ Mobile/Telephone bill – if you have

- Digital Signature Certificate (DSC) is mandatory

Consequences of Non-Filing of DIR – 3 KYC

- If a DIN Holder failed to file DIR 3 KYC on due date the he /she will have to pay Rs. 5,000 as filing fee as penalty.

- In addition to the above penalty, any wrong information provided in the form will also be liable for penalty under Section 448 and 449 of the Companies Act, 2013 and relevant provisions of the Indian Penal Code 1860.

- Further, a deactivated DIN means a person cannot act as a Director while his DIN is deactivated and any act done by him/her will be invalid and which might attract various penalties under Companies Act, 2013.

1. Whether multiple filing of form DIR-3 KYC is allowed?

System will not allow multiple filing of form DIR-3 KYC for an applicant. In case KYC is already filed for a DIN, and such DIN is entered again, system throws an error that the form is already filed.

2. Whether non-resident directors can provide Indian mobile numbers?

In case the DIN holder is a resident of India, the address must be an address in India and mobile number must be an Indian mobile number. In case DIN holder is non-resident, foreign address and foreign number shall only be allowed.

3. In case of having multiple DINs and have not filed DIR-3 KYC for any of the DINs. and wants to surrender the DIN but while Filling the form DIR-3 KYC, the DIN is not getting prefilled?

In case you have multiple DINs then you need to retain the oldest DIN and surrender all the latest DINs by filing DIR -5 e-form.

The post DIR-3 KYC : MANDATORY COMPLIANCE FOR DIN HOLDERS appeared first on Studycafe.

from Studycafe https://ift.tt/2LNIWO7

Monday, July 29, 2019

Last Date For Availing Benefit Of Alternate Composition Scheme- Form GST CMP-02

Last Date For Availing Benefit Of Alternate Composition Scheme- Form GST CMP-02

Last Date for availing the benefit of Alternate Composition Scheme is extended from 30.04.2019 to 31.07.2019 by vide notification No. 02/2019-Central Tax (Rate) dated 07.03.2019, as amended by notification No. 09/2019-Central Tax (Rate) dated 29.03.2019, an Alternate Composition Scheme has been made available to those suppliers of Services or Mixed Suppliers, who were not eligible for the primary composition scheme. Only those taxpayers are eligible for this Alternate Scheme whose annual turnover in the preceding financial year did not exceed Rs. 50 lakhs. Taxpayers opting to pay tax under this Scheme will pay tax at the rate of 6% (3% CGST +3% SGST) of their turn-over. vide Circular No. 97/16/2019- GST dated 05.04.2019, the Last Date for registered persons for filing the intimation in FORM GST CMP-02 for availing the benefit of the Alternate Composition Scheme was fixed at 30.04.2019.

Eligible taxpayers are encouraged to avail the benefit of the Alternate Composition Scheme by applying on or before 31.07.2019.

The post Last Date For Availing Benefit Of Alternate Composition Scheme- Form GST CMP-02 appeared first on Studycafe.

from Studycafe https://ift.tt/2Yto8NU

MCA has extended BEN-2 Date upto 30.09.2019 without payment of additional fee

General Circular No. 08/2019

F.No.01/01/2018-CL-V

GOVERNMENT OF INDIA

MINISTRY OF CORPORATE AFFAIRS

51″ Floor, ‘A’ Wing Shastri Bhawan,

Dr. R.P. Road, New Delhi

Dated: the 29th July, 2019

To,

All Regional Directors,

All Registrars of Companies, All Stakeholders.

Subject: Relaxation of additional fees and extension of last date of filing of Form BEN-2 under the Companies Act, 2013-regarding.

Sir,

The Ministry of Corporate Affairs has received several representations regarding extension of the last date for filing of e-Form No.BEN-2 without additional fees on account of companies (Significant Beneficial Owners) Second Amendment Rules, 2019 notified vide G.S.R. No. 446 (E) dated 01.07.2019. The matter has been examined and it is hereby informed that the time limit for filing e-form No.BEN-2 is extended upto 30.09.2019 without payment of additional fee and thereafter fee and additional fee shall be payable.

2.This issues with approval of the competent authority.

Yours Faithfully

Chandan Kumar

Deputy Director (Policy)

Copy to:-

- E-Governance Section and web contents Officer to place this circular on the Ministry website.

- Guard File.

The post MCA has extended BEN-2 Date upto 30.09.2019 without payment of additional fee appeared first on Studycafe.

from Studycafe https://ift.tt/2KahKWH

Compliance Overview For Private Limited Companies

Compliance overview for Private Limited Companies

Private Limited Company :

Private Limited Company is defined under Section 2(68) of the Companies Act, 2013 . It Means a company which by its articles :

(i) restricts the right to transfer its shares;

(ii) except in case of One Person Company, limits the number of its members to two hundred :

Provided that where two or more persons hold one or more shares in a company jointly, they shall, for the purposes of this clause, be treated as a single member :

Provided further that—

(A) persons who are in the employment of the company; and

(B) persons who, having been formerly in the employment of the company, were members of the company while in that employment and have continued to be members after the employment ceased,

– shall not be included in the number of members; and

(iii) prohibits any invitation to the public to subscribe for any securities of the company;

Kindly note that : Minimum Paid up Share Capital criteria is omitted.

An overview of Key Compliance requirements :

1. Meeting of Board of Directors :

First Meeting of Board of Directors is required to be held within 30 days of Incorporation of Company and thereafter 4 meetings are required to be held in every financial year.

Gap between two Board meetings : should not be more than 120 days.

Notice of Board meeting must be send before 7 days of meeting to every director by way of physical or through e-mail.

Kindly Note that : In First Board meeting, Company has to approve pre-incorporation expenses, authorize directors for issuing share certificate, signing the ROC Forms, and bank account opening, appoint first auditor of the company etc.

2. Issuing of Share Certificate

The Company is required to issue Share Certificates to the subscribers of memorandum within 60 days of Incorporation of Company.

3. Filling of Disclosure of interest by Directors :

a) MBP-1 [Pursuant to section 184 (1) and rule 9(1) of Companies (Meetings of Board and its Powers) Rules, 2014

Director of every company are required to give disclosures about their interest in any other business entity in first Board Meeting in which they participate as a Director and thereafter in First Board Meeting of every financial year in FORM MBP-1 to the Company.

b) DIR-8 Pursuant to Section 164(2) and rule 14(1) of Companies (Appointment and Qualification of

Directors) Rules, 2014Every director shall inform to the company concerned about his disqualification under section 164 (2), if any, in Form DIR-8 before he is appointed or re-appointed.

4. Annual General Meeting :

A company may hold its first annual general meeting, within a period of nine months from the date of closing of the first financial year of the company and in any other case, within a period of six months, from the date of closing of the financial year.

Registrar may, for any special reason, extend the time within which any annual general meeting, other than the first annual general meeting, shall be held, by a period not exceeding three months

Meeting must be held not later than 6 months from close of financial year.

5. Minutes of proceedings of Meeting of Board of Directors, General Meeting :

It is mandatory for every company to cause minutes of the proceedings of every meeting of Board of Directors, General meeting within 30 days of conclusion of meeting concerned. Minutes shall be preserved permanently and shall act as evidentially value in case of any dispute.

(Follow instructions as mentioned under revised SS-1 and SS-2)

6. Compliance with respect to Secretarial Standards :

a) SS-1 (SECRETARIAL STANDARD ON MEETINGS OF THE BOARD OF DIRECTORS)

b) SS-2 (SECRETARIAL STANDARD ON GENERAL MEETINGS)

7. Approval and Signing of Financial Statements :

The financial statement, including consolidated financial statement, if any, shall be approved by the Board of Directors before they are signed on behalf of the Board by the chairperson of the company where he is authorised by the Board or by two directors out of which one shall be managing director, if any, and the Chief Executive Officer, the Chief Financial Officer and the company secretary of the company, wherever they are appointed, or in the case of One Person Company, only by one director, for submission to the auditor for his report thereon.

8. Report by Board of Directors :

Every Company has to prepare a board report which shall include :

Details as mentioned under Section 134(3) of the Companies Act, 2013.

Briefly includes: state of the company, operations during the year, net profit, dividend declaration and its compliance with a set of financial, accounting and corporate social responsibility standards contains etc.

9. Event Based Compliances

- Receipt of share application money

- Allotment of shares

- Transfer of shares

- Appointment/Resignation of directors

- Appointment of Managing Director/ Whole Time Director

- Executing agreement with related parties

- Change in the Bank signatories

- Change in the statutory auditors

Overview of MCA – ROC Compliances :

| Applicable Laws/Acts | Due Dates | Compliance Particulars | Forms / Filing mode |

| Companies Act, 2013 | Within 180 Days From The Date Of Incorporation Of The Company | As per Section 10 A (Commencement of Business) of the Companies Act, 2013, inserted vide the Companies (Amendment) Ordinance, 2018 w.e.f. 2nd November, 2018, a Company Incorporated after the ordinance and having share capital shall not commence its business or exercise any borrowing powers unless a declaration is filed by the Director within 180 days from the date of Incorporation of the Company with the ROC. | MCA E- Form INC 20A |

| Companies Act, 2013 | within 90 days from the date of notification Dt. 08.02.2019

( i.e. On or before 8th of May, 2019) |

A person having Significant beneficial owner shall file a declaration to the reporting company

i.e. within 90 days of the commencement of the Companies (Significant Beneficial Owners) Amendment Rules, 2019 i.e. 08.02.2019 |

Form BEN-1 Draft Format available at |

| Companies Act, 2013 | 31.07.2019

Within 30 Days of 01.07.2019 |

Filing of form BEN-2 under the Companies (Significant Beneficial Owners) Rules, 2018.

(Within 30 days from deployment of the E -form (earlier the date of receipt of declaration in BEN-1 ) No additional fee shall be levied if the same is filed within 30 days from the date of deployment of the said e-form. |

Form BEN-2

(e-form deployed by Ministry (ROC)) on 01.07.2019 |

| Companies Act, 2013 | On or before 15.06.2019 (form can be filed after due date with a fee of Rs. 10000 (one time fee) | Filing of the particulars of the Company & its registered office. (by every company incorporated on or before the 31.12.2017.) Due date extended- LINK : |

Active Form INC -22A |

| Companies Act, 2013 | 30.09.2019 | *DIN KYC through DIR 3 KYC Form is an Annual Exercise.

Penalty after due date is Rs. 5000/-(one time) |

E-Form DIR – 3 KYC (Web Based) |

| Companies Act, 2013 | within 60 days from the conclusion of each half year | Reconciliation of Share Capital Audit Report (Half-yearly)

Pursuant to sub-rule Rule 9A (8) of Companies (Prospectus and Allotment of Securities) Rules, 2014 Applicable w.e.f. 30.09.2019 |

E-Form PAS- 6 (E-Form, Not yet deployed) |

| Companies Act, 2013 | With in 30 days of end of Half Yearly | Transaction during the year, which are deposits as well as and which are not deposits (exempted deposits)

Auditor’s Certificate is mandatory. This is to be filled every year. Can be filed after comply with the penal provisions. |

E -Form DPT – 3

(Half Yearly Return) |

ROC Annual Filings :

| Sl. No. | Particulars | Due Date | E- Form |

| 1 | Appointment of Auditor | With in 15 days from the conclusion of AGM | ADT-1 |

| 2 | Filing of financial statement and other documents with the ROC | With in 30 days from the conclusion of the AGM, other than OPC

(In case of OPC within 180 days from the close of the financial year) |

AOC-4 |

| 3 | Filing of annual return by a company. | With in 60 days from the conclusion of AGM | MGT-7 |

| 4 | Filing of Cost Audit Report with the Central Government | With in 30 days from the receipt of Cost Audit Report | CRA-4 |

| 5 | Filing of Resolutions and agreements to the Registrar | With in 30 days from the date of Board Meeting. | MGT-14 |

The post Compliance Overview For Private Limited Companies appeared first on Studycafe.

from Studycafe https://ift.tt/2LL8YBJ

Sunday, July 28, 2019

FILING PROCESS OF CMP-08

FILING PROCESS OF CMP-08

All the registered taxpayers paying tax under the provisions of section 10 of CGST Act 2017 or availing benefits of Notification No. 2/2019-Central Tax (Rate) dated 07th March 2019 have been categorized under ‘special category of persons’ by the CBDT. A special procedure has been laid out by the CBDT via Notification no. 21/2019 – Central Tax dated 23rd April 2019 for such persons to file their tax returns, registered under the composition scheme.

Such specified persons are required to furnish their return statement with the help of Form GST CMP-08 on a quarterly basis (on or before the 18th of the month following the quarter of any given financial year). GST CMP 08 form extended due date is 31st July for the quarter of April 2019 to June 2019.

Currently the extended due date for filing CMP-08 is 31st August,2019.

1. What is Form CMP-08?

Ans. A composition dealer will use the Form CMP-08, which is a special statement-cum-challan to declare the details or summary of his/her self-assessed tax payable for a given quarter. It also acts as a challan for making payment of tax. A composition dealer is a dealer who has been registered under the composition scheme of GST.

In addition to Form CMP-08, a composition dealer will also need to file his/her annual return via the revised format of Form GSTR-4 by 30 April following the end of a specific financial year.

2. Who should file CMP-08?

Ans. A taxpayer who has opted for the composition scheme has to CMP-08 in order to deposit payments every quarter. There are two kinds of taxpayers registered using CMP-02 (Opt into Composition scheme) :

A. The supplier of goods being manufacturers, retailers having an annual aggregate turnover of up to Rs 1.5 crore in the previous financial year, except :

- Manufacturer of ice cream, pan masala, or tobacco.

- A person making inter-state supplies.

- A casual taxable person or a non-resident taxable person.

- Businesses which supply goods through an e-commerce operator.

B. The supplier of services who fulfil the conditions mentioned under the Notification Number 2/2019 Central Tax (Rate) dated 7 March 2019 having the aggregate annual turnover up to Rs 50 lakh in the previous financial year.

3. What is the due date for filing the form CMP-08?

Ans. Form CMP-08 must be filed on a quarterly basis, on or before the 18th of the month succeeding the quarter of any specific financial year.

Revised due date is 31st August,2019.7.28

4. What is the penalty for not filing CMP-08 within the due date?

Ans. In case a taxpayer fails to furnish his/her return on or before the due date, he or she will be liable to pay a late fee of Rs 200 per day for every day of delay. i.e. Rs 100 per day under CGST and Rs 100 per day under SGST. IGST Act prescribes an amount equal to the late fees for CGST and SGST Act i.e Rs 200 per day of delay.

Late fee charges will be subject to a maximum of Rs 5,000 from the start of the due date to the actual return filing date of the taxpayer.

Filing Process of Form CMP-08

We can file CMP-08 in two ways :

1. Nil Return

2. Not a Nil Return

Let’s discuss the following topics in detail :

1. Nil Return

The taxpayer can file the nil return, if taxpayer not perform the below mentioned activities :

- Any outward supply(Commonly known as sale)

- Any liability due to reverse charge (including import of services)

- Any other tax liability.

The filing process for Nil CMP-08 are :

I. Log in at GST Portal.

II. Click on Services > Return Dashboard > Select Return Filing Period and Financial Year.

III. Click on CMP-08 then following window will get displayed :

IV. Click on “File Nil GST CMP-08” to file Nil CMP-08.

V. Then click on Save Tab.

VI. After Clicking on Save then click on “Preview Draft GST CMP-08”.

VII. After clicking on “Preview Draft GST CMP-08” then click on “File GST CMP-08” to file the form, Taxpayer can file the form as per applicability (EVC or DSC).

VIII. After Form CMP-08 is filed :

- ARN is generated on successful filing of the Form GSTR-4 Return.

- An SMS and an email are sent to the taxpayer on his registered mobile and email id.

2. Not a Nil Return

The taxpayer needs to file taxable CMP-08, if taxpayer perform the below mentioned activities :

- Any outward supply(Commonly known as sale)

- Any liability due to reverse charge (including import of services)

- Any other tax liability.

The filing process for Nil CMP-08 are :

I. Log in at GST Portal.

II. Click on Services > Return Dashboard > Select Return Filing Period and Financial Year.

III. Click on CMP-08 then following window will get displayed :

IV. The taxpayer needs to enter the details related to the below mentioned details :

- Outward supply (including exempt supply).

- Inward supplies attracting reverse charge including including import of services.

- Interest payable, if any.

V. After entering the details taxpayer needs to click on Save button.

VI. After Clicking on Save then click on “Preview Draft GST CMP-08”.

VII. After clicking on “Preview Draft GST CMP-08” then click on “Proceed to File” tab.

When taxpayer clicks on “Proceed to File” tab then status shows “Ready to File” and message shows “Compute Liabilities request has been received,please check the status in sometime”.

VIII. After clicking on “Proceed to File” tab following window will get displayed, where taxpayer view the reported liabilities and balance available in cash ledger.

IX. If sufficient balance is available in cash ledger then click on “File GST CMP-08”, if not then click on “Create Challan” and paid the tax liabilities accordingly.

X. After clicking on “File GST CMP-08” to file the form, Taxpayer can file the form as per applicability (EVC or DSC).

XI. After Form CMP-08 is filed :

- ARN is generated on successful filing of the Form GSTR-4 Return.

- An SMS and an email are sent to the taxpayer on his registered mobile and email id.

The post FILING PROCESS OF CMP-08 appeared first on Studycafe.

from Studycafe https://ift.tt/2GBHWIF

Saturday, July 27, 2019

Decisions Taken in 36th GST Council Meeting

Decisions Taken on 36th GST Council Meeting

The 36th GST Council Meeting was held here today Via Video Conference under the chairmanship of Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman. The meeting was also attended by Union Minister of State for Finance & Corporate Affairs Shri Anurag Thakur besides Revenue Secretary Shri Ajay Bhushan Pandey and other senior officials of the Ministry of Finance. The Council has recommended the following :

A. GST rate related changes on supply of goods and services

(i) The GST rate on all electric vehicles be reduced from 12% to 5%.

(ii) The GST rate on charger or charging stations for Electric vehicles be reduced from 18% to 5%.

(iii) Hiring of electric buses (of carrying capacity of more than 12 passengers) by local authorities be exempted from GST.

(iv) These changes shall become effective from 1st August, 2019.

B. Changes in GST law :

(i) Last date for filing of intimation, in FORM GST CMP-02, for availing the option of payment of tax under notification No. 2/2019-Central Tax (Rate) dated 07.03.2019 (by exclusive supplier of services), to be extended from 31.07.2019 to 30.09.2019.

(ii) The last date for furnishing statement containing the details of the self-assessed tax in FORM GST CMP-08 for the quarter April, 2019 to June, 2019 (by taxpayers under composition scheme), to be extended from 31.07.2019 to 31.08.2019.

(Note: The recommendations of the GST Council have been presented in this release in simple language for information of all stakeholders. The same would be given effect through relevant Circulars/Notifications which alone shall have the force of law.)

The post Decisions Taken in 36th GST Council Meeting appeared first on Studycafe.

from Studycafe https://ift.tt/2Gw36YP

GST rates on electric vehicle reduced from 12% to 5%

GST rates on electric vehicle reduced from 12% to 5%

36th GST Council Meeting chaired by Finance Minister Nirmala Sitharaman, was held via video conferencing.

In the meeting it has decided to reduce GST rate on Electrical Vehicles from 12% to 5% and on EV Chargers from 18% to 5% from 1st August 2019.

GST Council also approved exemption from GST on hiring of Electric Buses by local authorities.

The new rates will be effective from 1st August 2019.

The move is seen as a much needed step to encourage the adoption of EVs by people. The EV manufacturers had been asking for a cut in the GST rate on electric vehicles.

The government is aggressively pushing the adoption of EVs. In her maiden Budget, Nirmala Sitharaman had proposed an income tax deduction of Rs 1.5 lakhs on interest paid on loans taken for EVs.

The post GST rates on electric vehicle reduced from 12% to 5% appeared first on Studycafe.

from Studycafe https://ift.tt/2MmnZt1

Friday, July 26, 2019

GST council meeting postponed; rescheduled for July 27

GST council meeting postponed; rescheduled for July 27

The 36th GST Council meeting, which was to be held on thrusday through video conferencing has been rescheduled for July 27. The meeting was to be held on 25.07.2019.

According to sources, the meeting has two items to consider. First item is to consider gst rates for electric vehicles, chargers and hiring of EVs. Initially the proposal was to cut the rate on electric vehicles to 5 per cent from 12 per cent and on chargers to 5 per cent from 18 per cent, and on hiring to 5 per cent from 18 per cent. The second item is to extend the last date for enrolling under alternate composition scheme for service providers. The last date as of now is July 31.

Decisions to be taken in 36th GST council meeting

GST rates on electronic vehicles

After several announcement for electronic vehicle(EV) sector including income tax exemption and reduction in custom duties for certain components, the government is now expected to push for a GST rate cut on EVs from 12% to 5%.

GST rates on lottery

The Council may also look at taxation of lotteries. In the previous meeting, the Council had decided to seek legal opinion of the Attorney General for levying GST. Currently, a state-organised lottery attracts 12% GST, while a state-authorised lottery attracts 28% tax .

The post GST council meeting postponed; rescheduled for July 27 appeared first on Studycafe.

from Studycafe https://ift.tt/2JTjzIo

FAQ on Filing Form GSTR-10

FAQ on Filing Form GSTR-10

Manual > Form GSTR-10

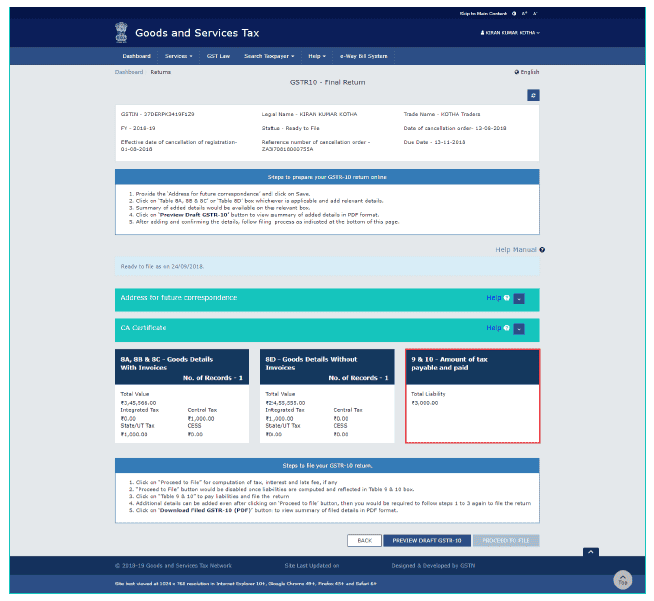

How can I create and file details in Form GSTR-10 (Final Return)?

To create and file details in Form GSTR-10 (Final Return), perform following steps :

A. Login and Navigate to Form GSTR-10 page

B. Update Address for Future Correspondence

C. Update Particulars of certifying Chartered Accountant or Cost Accountant

D. Enter details in various tiles

(i) D(1). 8A, 8B & 8C – Goods Details With Invoices

(ii) D(2). 8D – Goods Details Without Invoices

E. Preview Form GSTR-10

F: Proceed to File and Payment of Tax

G. File Form GSTR-10 with DSC/ EVC

H. Download Filed Return

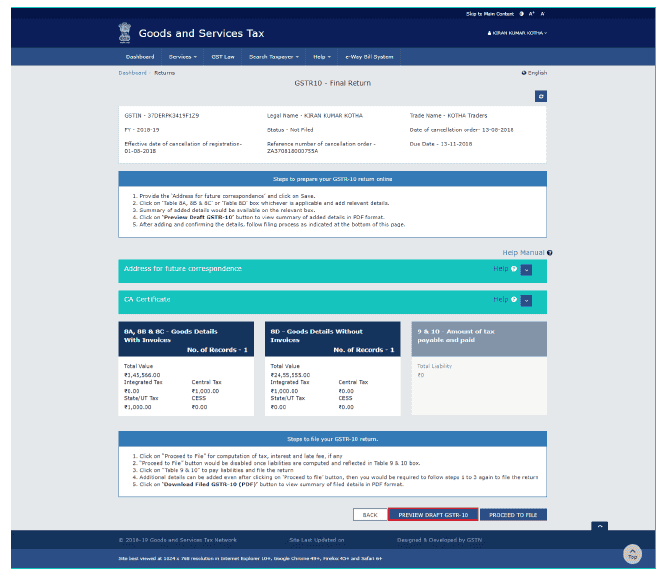

A. Login and Navigate to Form GSTR-10 page

1. Access the www.gst.gov.in URL. The GST Home page is displayed.

2. Login to the GST Portal with valid credentials.

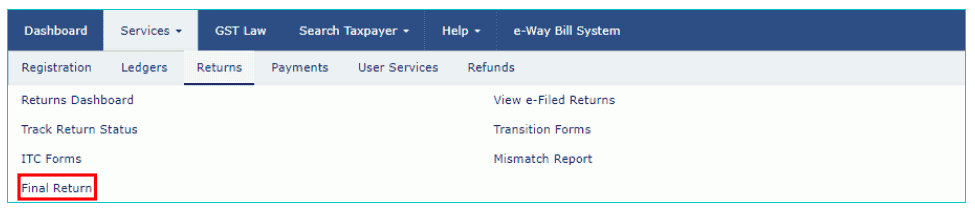

3. Click the Services > Returns > Final Return command.

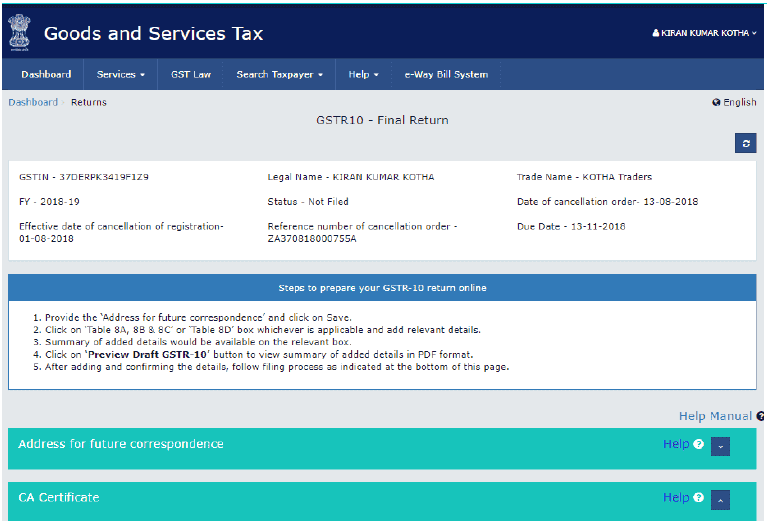

4. The Final Return page is displayed.

5. Please read the important message in the box carefully.

6. In the GSTR-10 tile, click the PREPARE ONLINE button if you want to prepare the return by making entries on the GST Portal.

7. The GSTR-10 – Final Return dashboard page is displayed.

B. Update Address for Future Correspondence

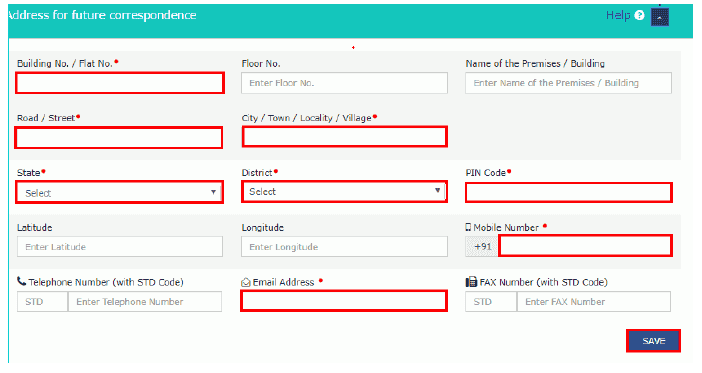

8. Enter the address for future correspondence.

Note : In cases, where application for cancellation is filed in Form REG-16, address details would be auto-populated from Form REG-16 and is shown in editable format.

9. Click the SAVE button.

10. A success message is displayed that request has been accepted successfully.

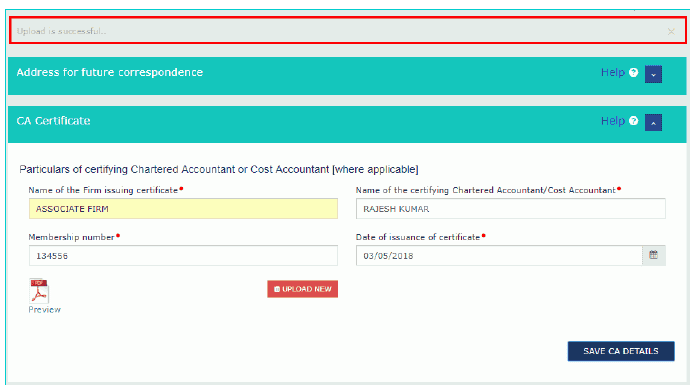

C. Update Particulars of certifying Chartered Accountant or Cost Accountant (If applicable)

11. In case, you want to update details of Chartered Accountant or Cost Accountant, enter the following details (if applicable) under the section on Particulars of certifying Chartered Accountant or Cost Accountant :

a) Name of the certifying accounting firm.

b) Name of the certifying Chartered Accountant / Cost Accountant in the certifying firm.

c) Membership number of the certifying firm.

d) Date of certificate issued by the certifying accounting firm.

12. Attach a scanned copy of the certificate.

13. Click SAVE CA details.

14. A success message is displayed that upload is successful.

D. Enter details in various tiles

Click on the tile names to know more about and enter related details :

D(1). 8A, 8B & 8C – Goods Details With Invoices: To add details of goods with invoices.

D(2). 8D – Goods Details Without Invoices: To add details of goods without invoices.

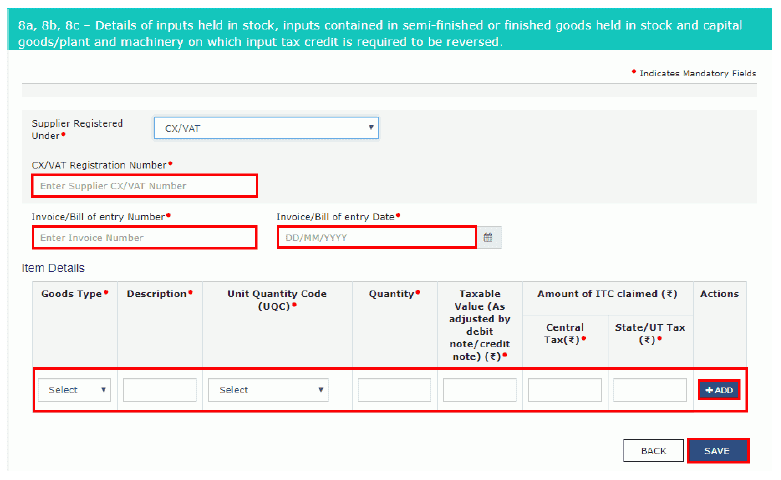

D (1). 8A, 8B & 8C – Goods Details With Invoices

15.1. Click the 8A, 8B & 8C – Goods Details With Invoices tile to add details of details of goods with invoices of suppliers registered in GST or CX/VAT regime.

15.2. Click the ADD DETAILS button.

15.3. Select the Supplier’s Registration, Registered Under (GST/CX/VAT) from the drop-down list.

15.4 (a). In case of supplier registered in GST regime:

15.4 (b). In case of supplier registered in CX/VAT regime:

15.4 (a). In case of supplier registered in GST regime :

i. In the GSTIN field, enter the GSTIN number of the supplier.

ii. In the Invoice/Bill of entry Number field, enter the invoice or bill of entry number.

iii. Select the Invoice/Bill of entry Date using the calendar.

iv. Enter the details of the item.

v. Click the ADD button.

vi. Click the SAVE button.

vii. A success message is displayed and invoice is added. You can click edit/delete button to edit/ delete the invoices (under Actions). Click the BACK button.

15.4 (b). In case of supplier registered in CX/VAT regime :

i. In the CX/VAT Registration Number field, enter the CX or VAT Registration number of the supplier.

ii. In the Invoice/Bill of entry Number field, enter the invoice number.

iii. Select the Invoice/Bill of entry Date using the calendar.

iv. Enter the details of the item.

v. Click the ADD button.

vi. Click the SAVE button.

vii. A success message is displayed and invoice is added. You can click edit/delete button to edit/ delete the invoices (under Actions). Click the BACK button.

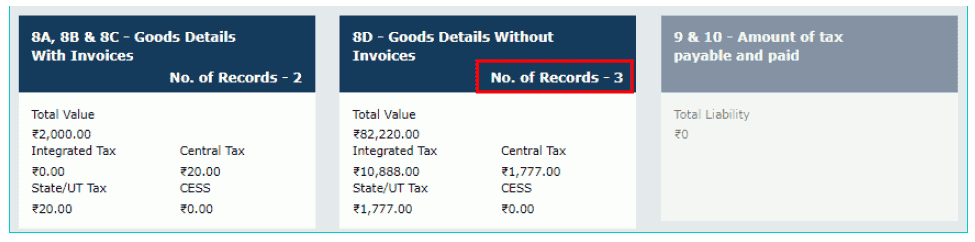

15.5. You will be directed to the GSTR-10 Dashboard landing page and the 8A, 8B & 8C – Goods Details With Invoices box in Form GSTR-10 will reflect the total number of records, value of goods etc..

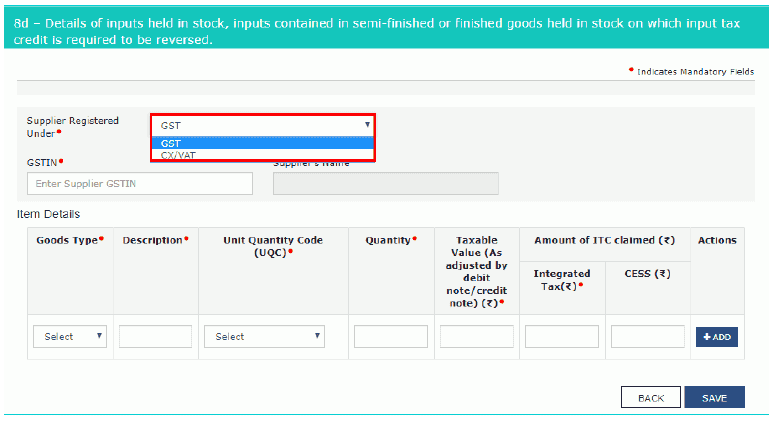

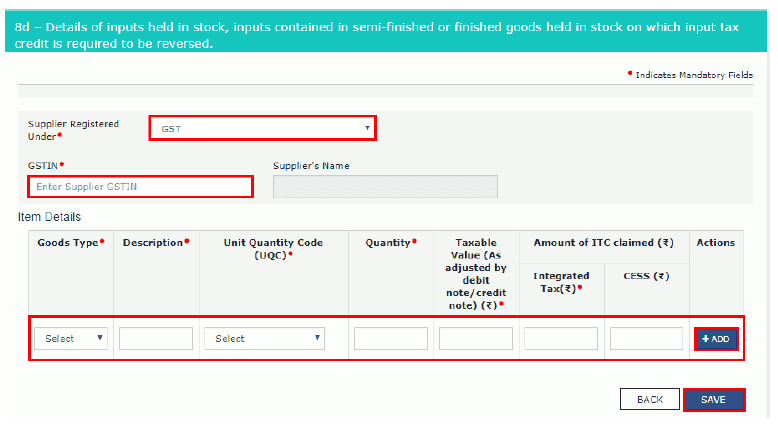

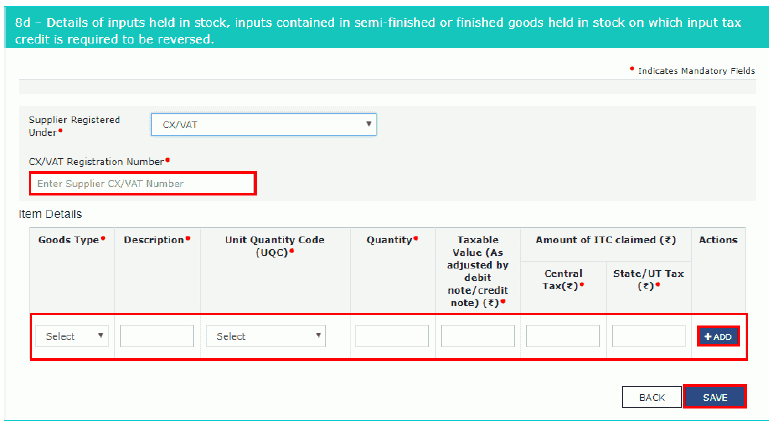

D(2). 8D – Goods Details Without Invoices

15.1. Click the 8D – Goods Details Without Invoices tile to add details of goods without invoices of suppliers registered in GST or CX/VAT regime.

15.2 (a) With GSTIN/CX/VAT Tab:

15.2 (b) Without GSTIN/CX/VAT Tab:

15.2 (a) With GSTIN/CX/VAT Tab:

i. Click the ADD DETAILS button.

ii. Select the Supplier’s Registration, Registered Under (GST/CX/VAT) from the drop-down list.

15.2 (a.1) In case of supplier registered with GST regime:

15.2 (a.2 ) In case of supplier registered with CX/VAT regime:

15.2 (a.1) In case of supplier registered with GST regime:

iii. In the GSTIN field, enter the GSTIN number of the supplier.

iv. Enter the details of the item.

v. Click the ADD button.

vi. Click the SAVE button.

vii. A success message is displayed and record is added. You can click edit/delete button to edit/ delete the records (under Actions). Click the BACK button.

15.2 (a.2 ) In case of supplier registered with CX/VAT regime:

iii. In the CX/VAT Registration Number field, enter the CX or VAT Registration number of the supplier.

iv. Enter the details of the item.

v. Click the ADD button.

vi. Click the SAVE button.

vii. A success message is displayed and record is added. You can click edit/delete button to edit/ delete the records (under Actions). Click the BACK button.

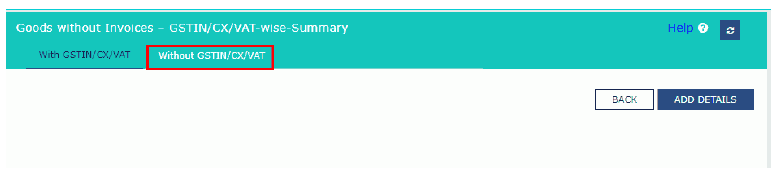

15.2 (b) Without GSTIN/CX/VAT Tab:

i. Select the Without GSTIN/CX/VAT tab.

ii. Click the ADD DETAILS button.

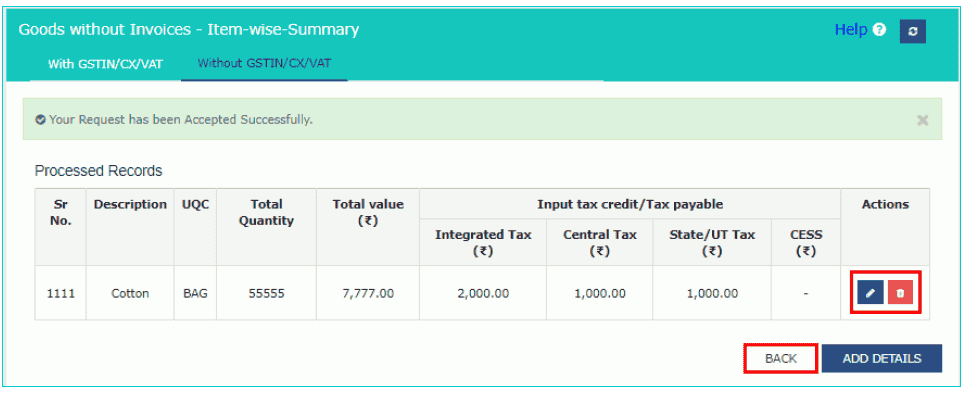

iii. In the Sr.No field, enter the serial number.

iv. Select the Goods Type from the drop-down list.

v. In the Description of Goods field, enter the goods description.

vi. In the UQC field, select UQC.

vii. In the Total Quantity field, enter the quantity.

viii. In the Total Taxable Value field, enter the Total Taxable Value of the outward supply.

ix. Enter the Integrated Tax, Central Tax and State/UT Tax details.

x. A success message is displayed and record is added. You can click edit/delete button to edit/ delete the records (under Actions). Click the BACK button.

15.3. You will be directed to the GSTR-10 Dashboard page and the 8D – Goods Details Without Invoices box in Form GSTR-10 will reflect the total number of records, value of goods etc.

E. Preview Form GSTR-10

16. Once you have entered all the details, click the PREVIEW DRAFT GSTR-10 button. This button will download the draft Summary page of Form GSTR-10 for your review. It is recommended that you download this Summary page and review the summary of entries made in different sections carefully. The PDF file generated would bear watermark of draft

as the details are yet to be filed.

17. The downloaded PDF is displayed.

F. Proceed to File and Payment of Tax

18. Click the PROCEED TO FILE button.

19. A message is displayed on top page of the screen that Proceed to file request has been received. Please check the status in sometime. Click the Refresh button.

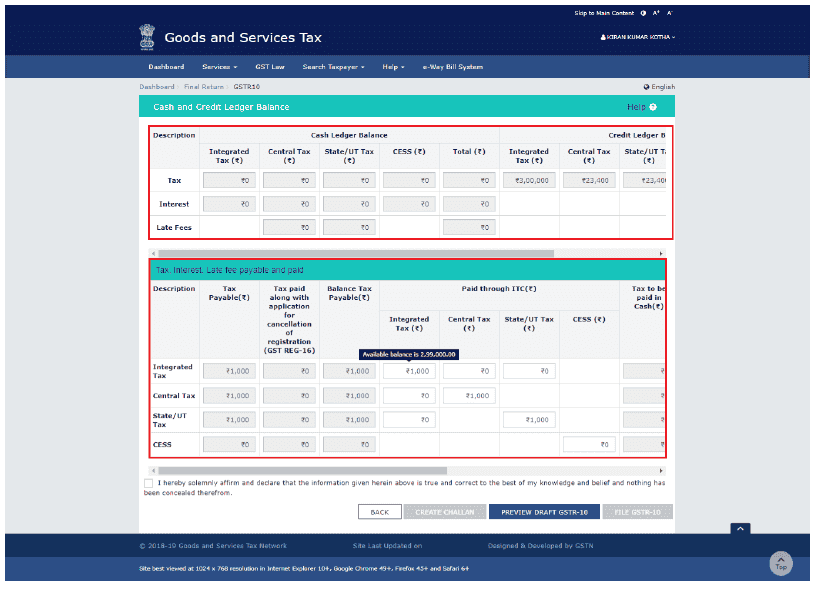

20. Once the status of Form GSTR-10 is Ready to File, 9 & 10 – Amount of tax payable and paid tile gets enabled. Clickthe 9 & 10 – Amount of tax payable and paid tile.

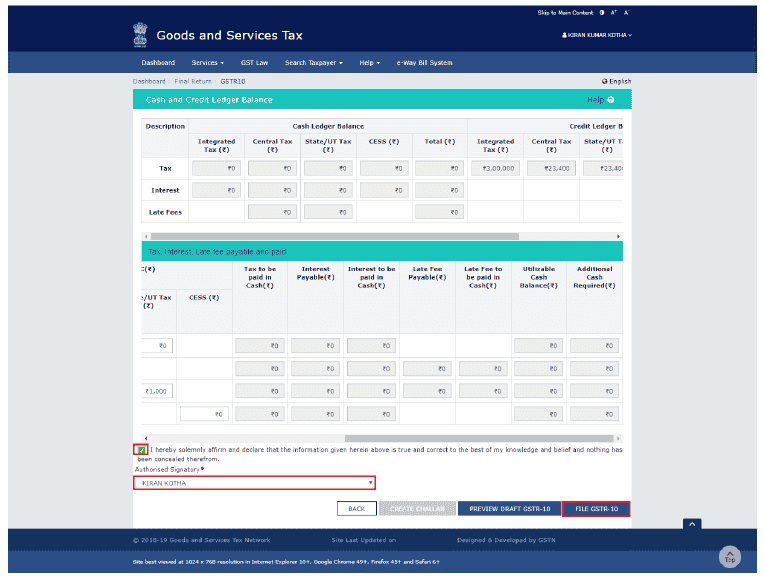

21.1. The cash and credit ledger balance as available on date are shown in below table :

21.2 (a). Scenario 1: If available balance in Electronic Cash Ledger/ Credit Ledger is less than the amount required to offset the liabilities

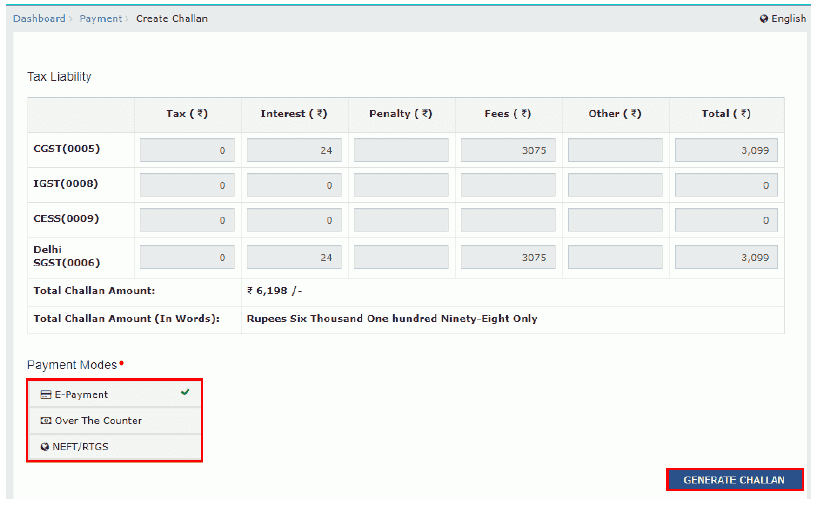

i. If available balance in Electronic Cash Ledger/ Credit Ledger is less than the amount required to offset the liabilities, then a part payment of liability can be made from available balance from the Electronic Cash Ledger/Credit Ledger. You may directly create challan for payment of remaining part of liability by clicking on the CREATE CHALLAN button.

ii. The Create Challan page is displayed.

Note :

(a) In the Tax Payment grid, the Total Challan Amount field and Total Challan Amount (In Words) fields are auto populated with total amount of payment to be made.

(b) You cannot edit the amount in challan.

iii. Select the Payment Modes as E-Payment/ Over the Counter/NEFT/RTGS.

iv. Click the GENERATE CHALLAN button.

v. The Challan is generated.

Note :

(i) In case of Net Banking : You will be directed to the Net Banking page of the selected Bank. The payment amount is shown at the Bank’s website. If you want to change the amount, abort the transaction and create a new challan.

In case of successful payment, you will be re-directed to the GST Portal where the transaction status will be displayed.

(ii) In case of Over the Counter : Take a print out of the Challan and visit the selected Bank. Pay using Cash/ Cheque/ Demand Draft within the Challan’s validity period. Status of the payment will be updated on the GST Portal after confirmation from the Bank.

(iii) In case of NEFT/ RTGS : Take a print out of the Challan and visit the selected Bank. Mandate form will be generated simultaneously. Pay using Cheque through your account with the selected Bank/ Branch. You can also pay using the account debit facility. The transaction will be processed by the Bank and RBI shall confirm the same within <2 hours>. Status of the payment will be updated on the GST Portal after confirmation from the Bank.

Click here to refer the FAQs and User Manual on Making Payment.

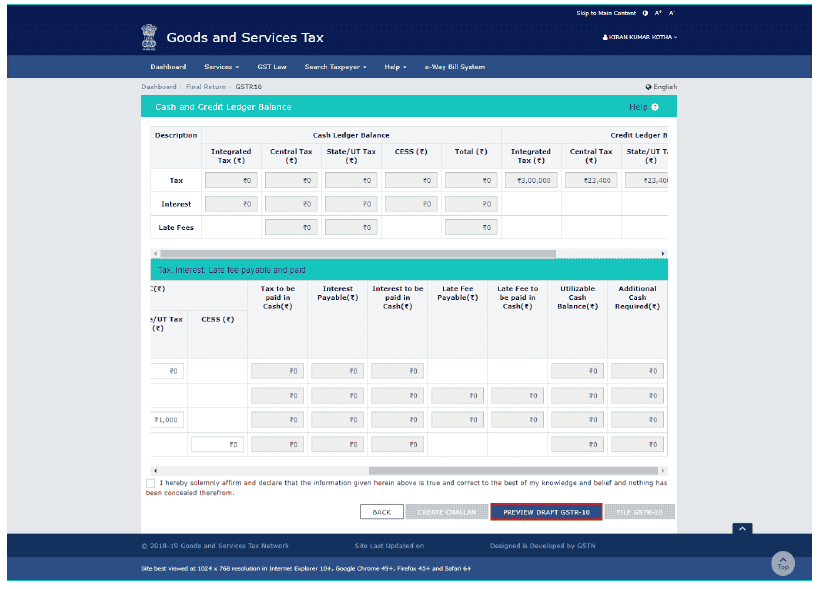

21.2 (b). Scenario 2: If available balance in Electronic cash ledger/Credit Ledger is more than/equal to the amount required to offset the liabilities

i. If available balance in Electronic Cash Ledge/Credit Ledger is more than/equal to the amount required to offset the liabilities, no additional cash is required for paying liability. Credit ledger can also be used to pay the tax liabilities. Credit utilization are auto populated and are editable. Reference for auto population of amount made at the time of cancelling of

registration are also populated in the payment table.

22. Click the PREVIEW DRAFT GSTR-10 button to view the summary page of Form GSTR-10 for your review. It is recommended that you download this Summary page and review the summary of entries made in different sections carefully before making payments.

23. The summary page of Form GSTR-10 is displayed.

G. File Form GSTR-10 with DSC/ EVC

24. Select the Declaration checkbox.

25. Select the Authorized Signatory from the drop-down list.

26. Click the FILE GSTR-10 button.

27. Click the YES button.

28. The Submit Application page is displayed. Click the FILE WITH DSC or FILE WITH EVC button.

29.1. FILE WITH DSC :

a. Select the certificate and click the SIGN button.

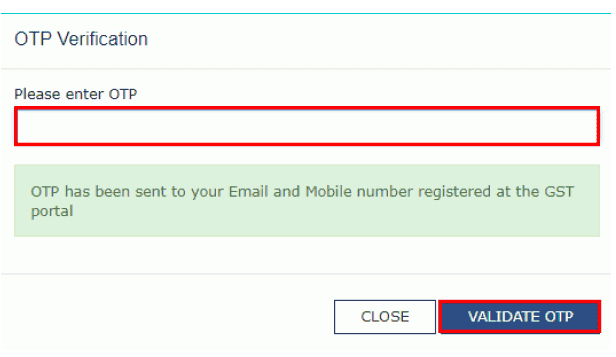

29.2. FILE WITH EVC :

a. Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the VALIDATE OTP button.

30. The success message is displayed and ARN is displayed. Status of the Form GSTR-10 return changes to “Filed”. Click the BACK button.

Note : After Form GSTR-10 is filed :

(i) ARN is generated on successful filing of the Form GSTR-10 Return.

(ii) An SMS and an email are sent to the taxpayer on his registered mobile and email id.

(iii) Electronic Cash/ Credit ledger and Electronic Liability Register Part-I will get updated on successful set-off of liabilities.

(iv) The return filed shall be saved in the Record Search and will be made available to tax official also.

H. Download Filed Return

31. Click the PREVIEW FINAL GSTR-10 button to download the filed return.

32. The PDF file generated would now bear watermark of final Form GSTR-10.

The post FAQ on Filing Form GSTR-10 appeared first on Studycafe.

from Studycafe https://ift.tt/2GIZAuj