S. 147 Reopening for taxing bogus share application money

IN THE HIGH COURT OF DELHI AT NEW DELHI

JUDGMENT

1. The present petition under Article 226 of the Constitution of India is directed against the notice issued to the petitioner dated 31.03.2019 under Section 148 of the Income Tax Act, 1961 for re-opening the assessment for Assessment Year 2012-13, and order of the Assistant Commissioner of Income Tax Circle 20(2), Delhi, dated 04.09.2019, disposing of the objections preferred by the petitioner to the said notice.

2. The brief facts are as under:

(i) Petitioner is engaged in the business of carrying out civil construction and other similar contract works. It filed its return of income for A.Y. 2012- 13 declaring total income at Rs.16,68,78,9601. The case was selected for scrutiny. An order of assessment was passed under Section 143(3) on 07.07.2014, where disallowance u/s 14A and 43B of the Income Tax Act were made.

(ii) A notice was issued to the petitioner/ assessee on 31st March 2019 under Section 148 to reopen the assessment for the Assessment Year 2012-13. The reasons recorded by the A.O. for formation of his belief that income chargeable to tax had escaped assessment, in brief, were that M/s Shail Investment Pvt. Ltd. and M/S New Delhi Credits Private Limited are companies controlled by one Sh. Tarun Goyal, who is an accommodation entry provider. This fact had been established in proceeding relating to the said Sh. Tarun Goyal before the ITAT and the High Court. On perusal of bank statements, and investigation report, it was found that the assessee company received Rs. 4,10,00.000 – from M/S Shail Investment Pvt. Ltd. and Rs. 4,10,00,000 – from M/S New Delhi Credits Private Limited during the previous year, relevant to the assessment year in question. Both these companies were amongst the 90 companies promoted by Sh. Tarun Goyal and registered at the same address at which the other companies engaged in providing accommodation entries were registered by Sh. Tarun Goyal. The assessment was reopened on the ground that the credit entries as received by the assessee remain unexplained, and that the assessee had not disclosed its true income in its ITR.

(iii) The assessee preferred its objections to the said reopening, which were rejected vide order dated 04.09.2019. The said order has also been challenged in these proceedings.

(iv) The relevant extract from the reasons recorded by the A.O. read as follows:

“3. Analysis of Information Received

As per the information gathered by the investigation wing, it was found that M/s Shail Investments Private Limited was being operated by Sh. Tarun Goyal, an entry operator. A brief summary of the adjudications by the Hon’ble ITAT, New Delhi in the cases of Sh. Tarun Goyal and the shell companies operated by him are as below:

A gist of the judgment of Hon’ble ITAT is as below:

“3 Facts in brief: A search and seizure operation was carried out u/s 132 of the IT Act 1961, on Tarun Goyal Group of Companies on 15.9.2008. Mr. Tarun Goyal is a tax consultant. He was running a racket of providing accommodation entries. We extract para 4 of the assessment order of Shri Tarun Goyal for AY 2004-05 dated 24/12/2010 for ready reference as this would give a glimpse of the Modus Operandi followed by the assessee.

4. At the outset, it would be pertinent to mention the modus operandi of the assessee and Sh. Tarun Goyal who was managing the company.

a. Sh. Tarun Goyal created a number of Private Ltd. companies and firms for providing accommodation entries. More than 90 companies were registered from the office premises of Sh.Tarun Goyal i.e. 13/34, W.E.A., Arya Samaj Road, Karol Bagh, New Delhi. The directors of these companies were his employees, who worked in his office as peons, clerks, receptionists, etc. All the documents including blank cheques were got signed from these employees. A number of bank accounts were got opened in the names of these companies and his employees.

b. The general modus operandi was to accept cash from the beneficiary. The cash was deposited in bank account and cheques were issued to the beneficiaries. The assessee in order to disguise his transactions as genuine has been following ‘layering’ of accounts where in cash was introduced in various bank accounts of the assessee and through multiple cheque transactions passed from his various companies, cheques and were issued to the beneficiaries from one of his companies.

c. The cheques issued were usually shown for the following purposes:-

(a) Share capital introduction:

(b) Introduction of capital as advance through booking of flats etc. These were later cancelled / transferred on account of payment of default, thereby reversing the entry. This is clear from the papers seized during the search. One of them, page 120 of Annexure-6 is attached with the order for ready reference (Annexure A-1 of this assessment order).

All companies of Tarun Goyal are having common address i.e. 13/34, WEA, Arya Samaj Road, Karol Bagh, New Delhi or 203, Dhaka Chamber, 2069/39, Naiwala, Karol Bagh, New Delhi. The office space at 13/34, WEA, Arya Samaj Road, 4th Floor, Karol Bagh, New Delhi is approx. 440 sqft. and many group companies are registered at this address. The employees who are also directors in these companies also denied to have any knowledge regarding capital and actual working of these companies and admitted that they are servant / employees in this group of companies and getting salary from Shri Tarun Goyal and sign the papers as per his direction. These companies are registered with ROC and main business of most of the companies was reflected as share trading and investments. There were no physical assets of these companies. In fact, these are paper companies run by Shri Tarun Goyal for providing accommodation entries to the beneficiaries by taking cash and in order to disguise his transaction as genuine have been following layering of accounts, through these companies.

4. Statements were recorded from Shri Tarun Goyal as well as some of the directors of Tarun Goyal Group of Companies.

5. Mr. Tarun Goyal confessed and admitted to the charge of providing accommodation entries by floating numerous companies and following layering of accounts, after cash was introduced in various companies.

6. Letter dated 14.12.2010 given by Mr. Tarun Goyal as given by the AO is extracted for ready reference:

“6. During the course of assessment proceedings the assessee submitted vide letter dated 14-12- 2010, “It is respectfully submitted:

1. That the Investigation Wing of the Department during the search proceedings and during the post search Investigations, framed the case against the undersigned and its group of companies, that it collected cash from various companies and issued cheques in lieu thereof, known as “accommodation entry”. And that the undersigned and its companies earned a commission on the said accommodation entry. In order to have a peace of mind and to settle the matter for all times to come, the undersigned agreed to the commission income and accordingly, surrendered the commission income on accommodation entry of Rs.40 crores, with a commission income of Rs. 10 lacs, which has been accounted for as income in the personal income tax return of the undersigned Mr.Tarun Goyal during the year of the search viz. A.Y. 2009-10.

2. That a detail of all the cash deposits in various accounts has already been submitted before your honor.

3. That the commission can be taxed either at the time of cash receipt and deposit in the Bank or at the time of issue of the cheques. The same income can not be taxed twice.

4. It is now requested that commission income be taxed only at the point of cash deposit because only the transactions originated with the cash deposits are the “accommodation entry” transactions. Other transactions are the genuine and bona fide business transactions on which income has accrued and accounted for in the books of account of each individual company and duly explained in each cash accordingly.

5. That since the commission has already been surrendered and offered for tax at the entry point, it should not be taxed twice (against at the exit point).

6. That the undersigned agreed and offered to revenue in the voluntary disclosure, an addition income by treating a commission @ Rs.2.50 per thousand on Rs.40 crores of accommodation entry, whereby a total additional income of Rs.10 lacs was offered for tax in the voluntary Any addition beyond this will put an undue hardship on the undersigned and its group of companies, and will lead unnecessary litigation, waste of precious time, money and entry.”

7. Notices were issued u/s 153A to each of the above companies in the group. In response the assessees had filed returns of income u/s 139(1) r.w.s. 153A. The AO completed assessments in all the cases by making additions on account of; a) undisclosed commission earned and; b) unexplained credit being cash deposits etc. u/s 68.

Further, in the case of Pr. Commissioner Of Income Tax -6, New Delhi vs NDR Promoters Pvt. Ltd. vide ITA 49/2018 dated 17.01.2019, the Hon’ble Delhi High Court has reversed the deletion of additions made u/s 68 of the Income Tax Act, 1961 in the case of a beneficiary of the accommodation entries provided by Sh. Tarun Goyal and upheld the findings of the assessing officer as below:

“12. The present case would clearly fall in the category where the Assessing Officer had not kept quiet and had made inquiries and queried the respondent-assessee to examine the issue of genuineness of the transactions. The Tribunal unfortunately did not examine the said aspect and has ignored the following factual position:-

a. The shareholder companies, 5 in number, were all located at a common address i.e. 13/34, WEA, Fourth Floor, Main Arya Samaj Road, Karol Bagh, New Delhi.

b. The total investment made by these companies was Rs.1,51,00,000/-, which was a substantial amount.

c. Evidence and material on bogus transactions found during the course of search of Tarun Goyal. Evidence and material that the companies were providing accommodation entries to beneficiaries was not considered. “

The findings recorded as mentioned in the assessment order, which read as under:- “1. From the finding of search, it is evident and undeniable that all the companies including the alleged shareholders companies belong to Sh. Tarun Goyal. This is enforced even more from the following:-

“i. All the companies are operated from the office premises of Sh. Tarun Goyal.

ii. All the directors are either his employees or close relatives. Sh. Tarun Goyal could never produce the directors nor furnish their residential address.

iii. The statement of employees of Sh. Tarun Goyal is on record, whereby they have clearly stated that they signed on the papers produced before them by Sh Tarun Goyal. They do not know about the basic details of the companies like shareholding patterns, nature of business of these companies etc.

iv. The statement of auditors of Sh. Tarun Goyal is on record. They have stated to have never met the directors of the companies and audited the accounts only on the directions of Sh.Tarun Goyal. As per the statement of auditors, the employees of Sh Tarun Goyal were directors of the companies run by them, also they could not ascertain the so called share capital subscribed by Sh Tarun Goyal as documentary proof of the same was lacking.

v. During the course of search, all the passbooks, cheque books, PAN Cards etc. were always in possession of Sh. Tarun Goyal. On his directions all the employees signed all the documents.

vi. All the bank account opening forms appear to be in the handwriting of Sh Tarun Goyal. All the books of accounts of all the companies have been retrieved from the computers/laptop of Sh Tarun Goyal.

vii. Sh Tarun Goyal has given letters for the release of bank accounts of companies put under restraints after search. No such application was received from so called directors of the companies.

viii. Sh Tarun Goyal appears in all the scrutiny assessments as well as appeals of his companies himself before various income tax authorities. From verification carried out in respective wards/circles where the above mentioned companies are assessed, it is evident that Sh Tarun Goyal is appearing in all the income tax proceedings on behalf of all the companies. He is not charging any fees for appearing in these cases.

ix. During the post search investigation it was revealed that besides, aiding and abetting the evasion of taxes, Sh Tarun Goyal has been indulging in violation of other provisions of the law of the land. This matter has also been taken up by REIC for multi-agency probe.”

e. The respondent-assessee did not have any business income in the year ending 31st March, 2007 and had income from other sources of Rs. 16.38 lakhs in the year ending 31st March, 2008. The respondent-assessee had not incurred any expenditure in the year ending 31st March, 2007 and had incurred expenditure of Rs.12.17 lakhs in the year ending 31st March, 2008.

f. Shares of face value of Rs.10/- each were issued at a premium of Rs.40/- (total 50/-).

g. The respondent-assessee had failed to produce Directors of the companies, though they had filed confirmations, and therefore, were in touch with the respondent-assessee. The respondent-assessee had also failed to produce the details and particulars with regard to issue of shares, notices etc. to the shareholders of AGM/EGM etc.”

13. In view of the aforesaid factual position, we have no hesitation in holding that the transactions in question were clearly sham and make-believe with excellent paper work to camouflage their bogus nature. Accordingly, the order passed by the Tribunal is clearly superficial and adopts a perfunctory approach and ignores evidence and material referred to in the assessment order. The reasoning given is contrary to human probabilities, for in the normal course of conduct, no one will make investment of such huge amounts without being concerned about the return and safety of such investment.

14. Accordingly, the appeal is allowed. The substantial question of law framed above is accordingly answered in favour of the appellant- revenue and against the respondent-assessee. There would be no order as to costs”

Thereby, from the above judgment, it is clearly seen that M/S Shail Investments Pvt. Ltd. is a shell entity operated by Sh. Tarun Goyal, working from the premises 13/34, W.E.A. Karol Bagh, New Delhi. It is also found from the examination of the bank account of M/S Shail Investments Pvt. Ltd. that the beneficiary of the transactions during FY 2011-12 in the case of the assessee is as below:

|

Name

|

PAN

|

Debits

|

Credits

|

Jurisdiction

|

|

RDS

Project Ltd.

|

AAACR4761J

|

4,10,00,000

|

|

Circle 20(2), Delhi

|

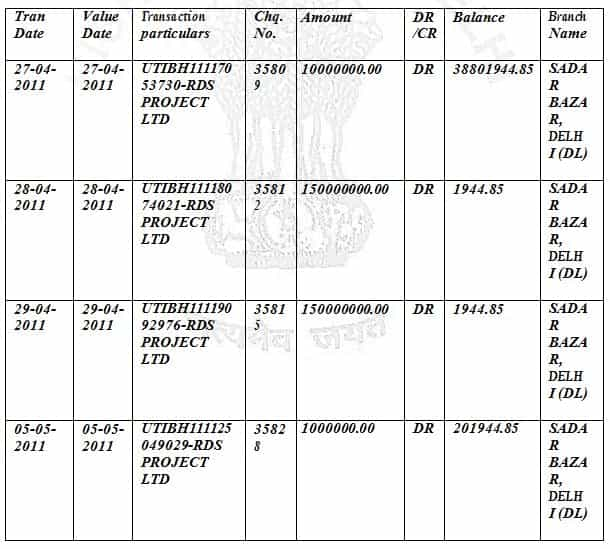

On perusal of the bank account maintain by M/s Shail Investments Pvt. Ltd. in Axis Bank reflects that amount of Rs.4,10,00,000/- was transferred to the account of the assessee company i.e M/s RDS Projects Ltd which is shown in. bank statement on the following dates:

From the above facts, it can be stated that M/s RDS project Ltd. has received credit of Rs.4,10,00,000/- from M/S New Delhi Credits Private Limited which are controlled by Sh. Tarun Goyal who is an ‘entry’ provider. The same was confirmed by Hon’ble High court also. Therefore, the transactions credit of Rs.8,20,00,000/- in account of the assessee company is remain unexplained.

|

Name

|

PAN

|

Debits

|

Credits

|

Jurisdiction

|

|

RDS Project Ltd

|

AAACR4761J

|

4,10,00,000

|

|

Circle 20(2), Delhi”

|

(emphasis supplied)

3. Learned counsel appearing on behalf of the petitioner submits that the reopening of assessment was done merely on the basis of the investigation report, and that there was no independent application of mind by AO while recording reasons, which is manifest by the fact that Ld. AO was not even aware that original assessment was made under section 143(3) and, that the reasons recorded by AO were based on borrowed satisfaction of some other authority. He submits that there is no cause and effect relationship between material found and formation of belief. Learned counsel for the petitioner also submitted that there is no nexus between the order of the ITAT and the High Court referred in the reason recorded, with the petitioner. M/s. Shail Investment Pvt. Ltd. and M/s. New Delhi Credits P. Ltd. are not amongst the companies which have been found either by the ITAT, or the High Court, to have been used to provide bogus entries.

4. Further, it is argued that reason recorded do not mention the satisfaction of AO about any failure of the petitioner to disclose material facts fully and truly even though original assessment was made u/s143(3) and reopening of assessment was done beyond four years making the reopening time barred.

5. Counsel for the petitioner relies on the Gujarat High Court’s decision in Himson Textile Engineering Industries Ltd v. N.N. Krishnan, (2013) 83 DTR 132(Guj), where it was held that “When the AO alleges that there is failure to disclose fully and truly all material facts, he should also be in a position to demonstrate as to what is the failure on the part of the assessee. Merely putting in a line as aforesaid would not satisfy the requirements of the proviso to Section 147 of the Act”.

6. The counsel also relies upon the Bombay High Court decision in Bombay Stock Exchange Ltd. Vs. Deputy Director of Income Tax (EXEMPTION) and ORS., (2014) 361 ITR 160(BOM), where reassessment proceedings and 148 were quashed due to the reason that AO had only made a simple averment in the reasons, that assessee had failed to disclose material facts, and did not indicate as to what material facts were not disclosed.

7. The petitioner also relied upon a Division Bench Judgment of this Court in Haryana Acrylic Manufacturing Co. vs. Commissioner of Income Tax and INR., (2009) 308 ITR 38 (DEL), where reopening of assessment after expiry of four years was held to be invalid on the ground that escapement of income from assessment must be occasioned by the failure on the part of assessee to disclose material facts. In that case reasons supplied to the petitioner did not contain any such allegation.

8. On the other hand, the petition is opposed by the revenue, contending that at the present stage, the test is not as to whether there has been an escapement of income, but whether there exist reasons to believe that the income chargeable to tax had escaped assessment, and in the present case there is sufficient tangible material on record which justifies the prima facie belief of A.O. regarding escapement of taxable income. Mr. Singh submitted that the basis of reopening was the information which was gathered by the revenue during the course of investigation of the Chartered Accountant, Tarun Goyal, who was found involved in the setting up of more than 90 bogus paper companies, through whom funds were routed to various beneficiaries, against deposits made in cash. The two companies viz. M/s. Shail Investments Private Ltd., and M/s. New Delhi Credits Private Ltd. are amongst the 90 odd companies floated by Tarun Goyal at the same address and they were used to provide accommodation entries to the petitioner.

9. The questions that arise for consideration are: whether there has been application of mind, or is it merely a case of change of opinion which forms the basis of the re-opening of assessment, and; whether, the objections of the petitioner have been properly dealt with, and; whether, the AO has acted on mere suspicion, or he had a good reason to believe that taxable income had escaped assessment.

10. In Assistant CIT Vs. Rajesh Jhaveri Stock Broker Pvt. Ltd., (2008) 14 SCC 208, the Supreme Court has held that the expression „reason‟ in Section 147 of the Act means a “cause” or “justification”. The Assessing Officer can be said to have reason to believe that income has escaped assessment, if he has a cause or justification to know, or suppose, that income has escaped assessment.

11. Counsel for the respondents relied on Sri Krishna Pvt. Ltd. Income Tax Officer, (1996) 87 Taxman 315 (SC), where it was emphasised that the enquiry at the stage of finding out whether the reassessment notice is valid, is only to see whether there are reasonable grounds for the Income Tax Officer to believe – and not that the omission and escapement of income is established.

12. We have heard learned counsels and perused the reasons recorded by the Revenue to re-open the assessment for the assessment year 2012-13; the objections filed by the petitioner, and; the order dated 04.09.2019 disposing of the said objections preferred by the petitioner. We have also considered the respective submissions and the decisions relied upon by them.

13. We had made it clear to learned counsel for the petitioner during the hearing, that looking to the facts and circumstances of the case – particularly the reasons recorded for re-opening, that we see no merit in the petitioner’s challenge to the notice for re-opening of the assessment proceedings. However, learned counsel continued to persist – even at the cost of consuming valuable judicial time. Accordingly, we have taken note of the detailed submissions and dealt with them in extenso.

14. What clearly emerges from a perusal of the reasons recorded by the respondent under Section 147 of the Act, is that the petitioner has received contribution from M/s Shail Investments Pvt. Ltd. and M/s New Delhi Credits Pvt. Ltd. towards share application money, at a premium, during the assessment year in question. Both these investor companies are promoted by Sh. Tarun Goyal, who has been found to have promoted about 90 such companies, many of which had the same address i.e. 13/34, W.E.A. Karol Bagh. Judicial findings have been returned against the said Tarun Goyal, and several of the companies floated by him to the effect that they are engaged in providing accommodation entries. Since the aforesaid two investor companies, namely, M/s Shail Investments Pvt. Ltd. and M/s New Delhi Credits Pvt. Ltd. are also promoted by Sh. Tarun Goyal, from the same premises, a serious doubt has arisen with regard to the genuineness of the transaction claimed by the petitioner/ assessee in the previous year, relevant to the Assessment Year 2012-13. The aforesaid reasons, in our view, are sufficient to justify the re-opening of the assessment. Merely because the petitioner’s assessment for the Assessment Year 2012-13 may have been undertaken under Section 143(3), is no reason to interfere with the re-assessment proceedings at this stage. This is for the reason that there is nothing to show that while passing the assessment order, the Assessing Officer had examined the aspect of genuineness of the transaction undertaken by the petitioner with M/s Shail Investments Pvt. Ltd. and M/s New Delhi Credits Pvt. Ltd. A perusal of the original assessment order shows that the Assessing Officer had accepted the claim made by the petitioner/ assessee with regard to the genuineness of the transaction without any scrutiny and by accepting the statement of the petitioner as truthful. At that stage, the material information, which the petitioner withheld and did not disclose, was that it was dealing with companies promoted by Sh. Tarun Goyal, who was engaged in the business of providing accommodation entries.

15. We may take note of the recent decision of the Supreme Court in Principal Commissioner of Income Tax (Central)- I v. NRA Iron & Steel Pvt. Ltd., (2019) 412 ITR 161 (SC) decided on 05.03.2019. The respondent assessee had shown receipt of share capital/ premium during the financial year 2009-10 aggregating to Rs.17.60 crore from 19 companies – some of which were based in Mumbai, some in Kolkata and some in Shares having face value of Rs.10 were subscribed by the said 19 investor companies in the assessee company at a premium of Rs.190 per share. It appears that the original assessment was completed and the investment made by the said 19 companies in the share capital/ premium of the respondent assessee company was accepted by the AO. Subsequently, a notice under section of the Act was issued on 13.04.2012 to reopen the assessment, for reasons recorded therein. The assessee filed its objections, which were rejected. Summons/ notices were also issued to the representatives of the investor companies. However, none appeared on behalf of either of them. The stand of the assessee company was that the amounts had been received through normal banking channels through account payeee cheques/ demand drafts and, therefore, there was no cause to take recourse to section 68 of the Act. The assessee claimed that it had discharged the onus upon it to establish the genuineness of the transactions under section 68 of the Act.

16. The AO made inquiries with regard to the genuineness of the transactions of investment in share capital with premium in the assessee company. In the independent inquiry, the AO found that the investor companies despite service of notice did not appear; that in respect of some of them, their office was found closed; some other entities were found not existing at the given address; in some cases, the premises was found to be owned by some other person. Consequently, notices could not be served in these cases. Even when they responded, the investor companies did not provide justification for applying in equity shares in the assessee company at a premium of Rs.190 per share.

17. The replies submitted by the investor companies were found to be incomplete and unsatisfactory. In regard to the said 19 investor companies, the finding recorded by the AO has been paraphrased by the Supreme Court in the following words:

“The AO recorded that the enquiries at Mumbai revealed that out of the four companies at Mumbai, two companies were found to be non-existent at the address furnished.

With respect to the Kolkata companies, the response came through dak only. However, nobody appeared, nor did they produce their bank statements to substantiate the source of the funds from which the alleged investments were made.

With respect to the Guwahati companies – Ispat Sheet Ltd. and Novelty Traders Ltd., enquiries revealed that they were non- existent at the given address.”

18. On the basis of the detailed inquiry, the AO found that:

“i. None of the investor-companies which had invested amounts ranging between Rs. 90,00,000 and Rs. 95,00,000 as share capital in the Respondent Company – Assessee during the A.Y. 2009-10, could justify making investment at such a high premium of Rs. 190 for each share, when the face value of the shares was only Rs. 10;

ii. Some of the investor companies were found to be nonexistent;

iii. Almost none of the companies produced the bank statements to establish the source of funds for making such a huge investment in the shares, even though they were declaring a very meagre income in their returns;

iv. None of the investor-companies appeared before the A.O., but merely sent a written response through dak.

The AO held that the Assessee had failed to discharge the onus by cogent evidence either of the credit worthiness of the so- called investor-companies, or genuineness of the transaction.”

19. Consequently, the AO added back the amount of Rs.17.60 crores to the total income of the assessee for the assessment year in question.

20. The CIT (Appeals) allowed the assessees’s appeal by observing, inter alia, that if the relevant details of the address of PAN identity of the creditor/ subscriber along with copies of the shareholders register, share application form, share transfer register etc. are available, the same would constitute acceptable proof or acceptable explanation by the assessee and that the department would not be justified in drawing an inference, only because the creditor/ subscriber fails or neglects to respond to the notice issued by the AO. In support of this conclusion, the CIT (Appeals) relied upon a decision of this Court in CIT v. Lovely Exports Pvt. Ltd., (2008) 299 ITR 268 (Delhi). The ITAT dismissed the Revenue’s appeal on 16.10.2017 on the ground that the assessee had discharged their primary onus to establish the identity and creditworthiness of the investors, especially when the investor companies had filed their return and were being assessed. The Revenue’s appeal before this court i.e. ITA No.244/2018 under section 260A of the Act was dismissed on 26.02.2018 on the ground that the issues raised before the High Court were factual, and that the lower appellate authorities had taken sufficient time to consider the relevant circumstances. This court held that no substantial question of law arose for its consideration.

20. In this background, the department appealed before the Supreme Court. The respondent assessee did not appear before the Supreme Court despite service. The Supreme Court heard the appeal on merits and considered the issue whether the respondent assessee had discharged the primary onus to establish the genuineness of the transaction required under section 68 of the Act. The Supreme Court held that the use of the words “any sum found credited in the books” in section 68 of the Act indicates that the section is widely worded, and includes investments made by the introduction of share capital or share premium. The Supreme Court relied on CIT v. Precision Finance Pvt. Ltd., (1994) 208 ITR 465 (Cal), wherein the Court held that the assessee was expected to establish to the satisfaction of the AO:

“• Proof of Identity of the creditors;

-

- Capacity of creditors to advance money; and

- Genuineness of transaction”

22. The Supreme Court also took note of its decision in Kale Khan Mohammad Harif v. CIT, (1963) 50 ITR 1 (SC), and Roshan Di Hatti v. CIT, (1977) 107 ITR (SC), wherein it had laid down the onus of proving the source of money found to have been received by the assessee, is on the assessee. Once the assessee has submitted the documents relating to identity, genuineness of the transactions and creditworthiness of the payee, then the AO must conduct an inquiry and call for more details before invoking section 68. If the assessee is not able to provide a satisfactory explanation of the nature and source of investment made, it is open to the revenue to hold that such investment is the income of the assessee, and that there would be no further burden on the revenue to show that the income is from any particular source. The Supreme Court also observed that with respect to the genuineness of the transaction, it is for the assessee to prove the same by cogent and credible evidence, since the investment was claimed to have been made in the share capital of the assessee company, it was for the assessee to establish that it was a genuine investment, since the facts are exclusively within the assessees knowledge. The Supreme Court also noticed the decision of this Court in CIT v. Oasis Hospitalities Pvt. Ltd., (2011) 333 ITR 119 (Delhi), wherein this Court observed:

“The initial onus is upon the assessee to establish three things necessary to obviate the mischief of Section 68. Those are: (i) identity of the investors; (ii) their creditworthiness/investments; and (iii) genuineness of the transaction. Only when these three ingredients are established prima facie, the department is required to undertake further exercise.”

23. Merely providing the identity of the investors does not discharge the onus of the assessee, if the capacity or creditworthiness has not been established. The Supreme Court also took note of the decision of the Calcutta High Court in Shankar Ghosh v. ITO, (1985) 23 ITJ (Cal), where the assessee failed to prove the financial capacity of the person from whom he had allegedly taken the loan. The said loan amount was rightly held to be the assessee’s own undisclosed income.

24. The Supreme Court also placed reliance on CIT v. Kamdhenu Steel & Alloys Ltd., (2012) 206 Taxman 254 (Delhi), wherein the Court had observed:

“38. Even in that instant case, it is projected by the Revenue that the Directorate of Income Tax (Investigation) had purportedly found such a racket of floating bogus companies with sole purpose of lending entries. But, it is unfortunate that all this exercise if going in vain as few more steps which should have been taken by the Revenue in order to find out causal connection between the case deposited in the bank accounts of the applicant banks and the assessee were not taken. It is necessary to link the assessee with the source when that link is missing, it is difficult to fasten the assessee with such a liability.”

25. It was held that the AO ought to have conducted an independent inquiry to verify the genuineness of the credit entires.

26. The Supreme Court also noticed several other decisions relating to the issue of unexplained credit entries/ share capital subscriptions. We may quote the relevant extract from the decision of the Supreme Court in this regard:

“i. In Sumati Dayal v. CIT, (1995) 214 ITR 801(SC)this Court held that:

“if the explanation offered by the assessee about the nature and source thereof is, in the opinion of the Assessing Officer, not satisfactory, there is prima facie evidence against the assessee, vis., the receipt of money, and if he fails to rebut the same, the said evidence being unrebutted can be used against him by holding that it is a receipt of an income nature. While considering the explanation of the assessee, the department cannot, however, act unreasonably”

ii. In CIT v. P. Mohankala, 291 ITR 278, this Court held that:

“A bare reading of section 68 of the Income-tax Act, 1961, suggests that (i) there has to be credit of amounts in the books maintained by the assessee ;

(ii) such credit has to be a sum of money during the previous year ; and (iii) either (a) the assessee offers no explanation about the nature and source of such credits found in the books or (b) the explanation offered by the assessee, in the opinion of the Assessing Officer, is not satisfactory. It is only then that the sum so credited may be charged to Income-tax as the income of the assessee of that previous year. The expression “the assessee offers no explanation” means the assessee offers no proper, reasonable and acceptable explanation as regards the sums found credited in the books maintained by the assessee.

The burden is on the assessee to take the plea that, even if the explanation is not acceptable, the material and attending circumstances available on record do not justify the sum found credited in the books being treated as a receipt of income nature.”

iii. The Delhi High Court in a recent judgment delivered in PR.CIT-6, New Delhi v. NDR Promoters Pvt. Ltd., 410 ITR 379 upheld the additions made by the Assessing Officer on account of introducing bogus share capital into the assessee company on the facts of the case.

iv. The Courts have held that in the case of cash credit entries, it is necessary for the assessee to prove not only the identity of the creditors, but also the capacity of the creditors to advance money, and establish the genuineness of the transactions. The initial onus of proof lies on the assessee. This Court in Roshan Di Hatti v. CIT, (1992) 2 SCC 378, held that if the assessee fails to discharge the onus by producing cogent evidence and explanation, the AO would be justified in making the additions back into the income of the assessee.

v. The Guwahati High Court in Nemi Chand Kothari v. CIT, (2003) 264 ITR 254 (Gau.) held that merely because a transaction takes place by cheque is not sufficient to discharge the burden. The assessee has to prove the identity of the creditors and genuineness of the :

“It cannot be said that a transaction, which takes place by way of cheque, is invariably sacrosanct. Once the assessee has proved the identity of his creditors, the genuineness of the transactions which he had with his creditors, and the creditworthiness of his creditors vis-a-vis the transactions which he had with the creditors, his burden stands discharged and the burden then shifts to the revenue to show that though covered by cheques, the amounts in question, actually belonged to, or was owned by the assessee himself”

(emphasis supplied)

vi. In a recent judgment the Delhi High Court in CIT v. N.R. Portfolio (P.) Ltd. [2014] 42 taxmann.com 339/222 Taxman 157 (Mag.) (Delhi), held that the credit-worthiness or genuineness of a transaction regarding share application money depends on whether the two parties are related or known to each other, or mode by which parties approached each other, whether the transaction is entered into through written documentation to protect investment, whether the investor was an angel investor, the quantum of money invested, credit-worthiness of the recipient, object and purpose for which payment/investment was made, etc. The incorporation of a company, and payment by banking channel, etc. cannot in all cases tantamount to satisfactory discharge of onus.

vii. Other cases where the issue of share application money received by an assessee was examined in the context of Section 68 are CIT v. Divine Leasing & Financing Ltd. (2007) 158 Taxman 440, and CIT v. Value Capital Service (P.) Ltd. [2008] 307 ITR 334.”

27. The principles culled out by the Supreme Court are contained in para 11 of its judgment, which read as follows:

“11. The principles which emerge where sums of money are credited as Share Capital/Premium are:

i. The assessee is under a legal obligation to prove the genuineness of the transaction, the identity of the creditors, and credit-worthiness of the investors who should have the financial capacity to make the investment in question, to the satisfaction of the AO, so as to discharge the primary onus.

ii. The Assessing Officer is duty bound to investigate the credit-worthiness of the creditor/subscriber, verify the identity of the subscribers, and ascertain whether the transaction is genuine, or these are bogus entries of name-lenders.

iii. If the enquiries and investigations reveal that the identity of the creditors to be dubious or doubtful, or lack credit-worthiness, then the genuineness of the transaction would not be established.

In such a case, the assessee would not have discharged the primary onus contemplated by Section 68 of the Act.”

27. The Supreme Court found that the AO had made inquiries, which revealed that there was no material on record to prove that the share application money had been received from independent entities, some of which were found to be non-existent and had no office at the address mentioned by the assessee. Some of the investor companies were found to lack the financial capacity to make such investments, and there was no explanation as to why the investor companies had subscribed to the shares of the assessee company at high premium of Rs.190 per share, when the face value was only Rs.10 per share. Moreover, the investor companies had not established the source of funds from which the high share premium was invested. Mere mention of the income tax file number of the investor was not sufficient to discharge the onus under section 68 of the Act. The Supreme Court held that the lower authorities, namely, the CIT (Appeals) and the ITAT had ignored the detailed findings of the AO and that they had erroneously held that merely because the assessee had filed all the primary evidence, the onus on the assessee under section 68 of the Act stood discharged. The Supreme Court held:

“13………………..The lower appellate authorities failed to appreciate that the investor companies which had filed income tax returns with a meagre or nil income had to explain how they had invested such huge sums of money in the Assesse Company – Respondent. Clearly the onus to establish the credit worthiness of the investor companies was not discharged. The entire transaction seemed bogus, and lacked credibility.The Court/Authorities below did not even advert to the field enquiry conducted by the AO which revealed that in several cases the investor companies were found to be non-existent, and the onus to establish the identity of the investor companies, was not discharged by the assessee.

14. The practice of conversion of un-accounted money through the cloak of Share Capital/Premium must be subjected to careful scrutiny. This would be particularly so in the case of private placement of shares, where a higher onus is required to be placed on the Assessee since the information is within the personal knowledge of the Assessee. The Assessee is under a legal obligation to prove the receipt of share capital/premium to the satisfaction of the AO, failure of which, would justify addition of the said amount to the income of the Assessee.

15. On the facts of the present case, clearly the Assessee Company – Respondent failed to discharge the onus required under Section 68 of the Act, the Assessing Officer was justified in adding back the amounts to the Assessee’s income.”

(emphasis supplied)

29. Consequently, the appeal preferred by the Revenue was allowed by the Supreme Court.

30. Though the said decision was rendered by the Supreme Court while dealing with a Civil Appeal arising from a decision of this Court dismissing the appeal under section 260A of the Act, the findings returned by the Supreme Court, as extracted herein above, are extremely pertinent and relevant in the present context as well.

31. One is known by the company one keeps. Sh. Tarun Goyal has been established to be engaged in the business of providing accommodation entries. He is the promoter of about 90 companies from the same set of addresses as aforesaid. Amongst the companies promoted by him are M/s Shail Investments Pvt. Ltd. and M/s New Delhi Credits Pvt. Ltd. These two companies have made investments in the petitioner/ assessee company during the previous year relevant to the assessment year in question as share application money. The aforesaid background raises serious doubts about the character of M/s Shail Investments Pvt. Ltd. and M/s New Delhi Credits Pvt. Ltd., as being mere vehicles for providing accommodation entries. These two companies appear to have dubious character and, thus, the genuineness of the transactions that these two companies have undertaken with the petitioner has come under a serious cloud, giving rise to a reasonable belief in the mind of the Assessing Officer that the petitioner may have indulged in a dubious transaction with the said M/s Shail Investments Pvt. Ltd. and M/s New Delhi Credits Pvt. Ltd. to launder its undisclosed income.

32. Pertinently, the petitioner does not dispute having received monies from these two dubious companies.

33. In our view, since the petitioner does not dispute the receipt of monies from M/s Shail Investments Pvt. Ltd. and M/s New Delhi Credits Pvt. Ltd. towards alleged capital infusion, the belief formed by the Assessing Officer, that taxable income of the petitioner has escaped assessment cannot, but, be described as reasonable.

34. The mere fact that the petitioner had produced evidence before the Assessing Officer during the scrutiny assessment proceeding that the said amount had been received as share application money from M/s Shail Investments Pvt. Ltd. and M/s New Delhi Credits Pvt. Ltd., and the fact that M/s Shail Investments Pvt. Ltd. and M/s New Delhi Credits Pvt. Ltd. may have invested monies in the assessee company for allotment of shares, is neither here, nor This is for the reason that one part of any such transaction would invariably be conducted through banking channels and would be duly recorded – whether the same is genuine or not. That is how money would be laundered. Thus, the fact that the monetary transaction has been conducted through a banking channel, and is acknowledged, does not render the opinion of the Assessing Officer regarding the escapement of taxable income illegal or unreasonable since, at the time of the conduct of scrutiny assessment proceedings, the assessee did not disclose the material fact that the so called investor – in this case M/s Shail Investments Pvt. Ltd. and M/s New Delhi Credits Pvt. Ltd., are promoted by Sh. Tarun Goyal, who is engaged in the business of providing accommodation entries, and the Assessing Officer had no basis to so assume. In fact, the assessment order dated 07.07.2014 passed by him is completely silent and innocuous on the said aspect.

35. Pertinently, no addition under Section 68 of the Income Tax Act was sought to be made on any account, much less on account of unexplained investments. A perusal of the assessment order dated 07.07.2014 shows that the Assessing Officer made disallowance under Section 14A read with Rule 8D to the tune of Rs.38,94,340/-, apart from making disallowance under Section 43B of the Act to the tune of Rs. 8,92,505/-. The aspect of receipt of capital investment from the said two companies, namely, M/s Shail Investments Pvt. Ltd. and M/s New Delhi Credits Pvt. Ltd. is not even noticed in the assessment order.

36. We may also refer to Explanation 1 to Section 147 of the Act which reads “Production before the Assessing Officer of account books or other evidence from which material evidence could with due diligence have been discovered by the Assessing Officer will not necessarily amount to disclosure within the meaning of the foregoing proviso.

37. The information/ knowledge that M/s Shail Investments Pvt. Ltd. and M/s New Delhi Credits Pvt. Ltd. are promoted by Tarun Goyal, who has been established to be an accommodation entry provider, by adopting the modus operandi of promoting different companies; layering the transactions and; providing the accommodation entries dawned upon the Assessing Officer only upon receipt of information from the Investigation Wing. Pertinently, Tarun Goyal has admitted his role in the illegalities, his modus operandi, and; surrendered undisclosed commission income. He has been judicially recognized as an accommodation entry provider.

38. We are not suggesting that all monetary transactions of a person/ entity indulging in the activity of providing accommodation entries, would justify the entertainment of a belief, that the taxable income of the third parties – with whom such monetary transactions are undertaken, has escaped assessment. This is because, the person/ entity found to be indulging in the activity of providing accommodation entries, may have entered into some genuine transactions as well. It would be essential for the Assessing Officer of such third party/ parties to find a live-link, i.e. a link which is actionable between the person/ entity indulging in the activity of providing accommodation entries and such third party/ Assessee. The person who has undertaken such financial transaction(s) with such a person/ entity (the bogus entry provider), cannot avoid further scrutiny of such a transaction by laying a challenge to the re-opening of the assessment under Section 147/148 of the Act when the re-opening is, otherwise, within the period of limitation.

39. In the present case, the live-link between the said material information, and the formation of the belief that taxable income has escaped assessment is the fact that the petitioner, admittedly, received Rs. 4.10 crores from M/s Shail Investments Pvt. Ltd. and M/s New Delhi Credits Pvt. Ltd. – each. This live-link is actionable as it was found and acted upon within the period of limitation under the proviso to Section 147 of the Act.

40. No doubt, on the one hand, sanctity of concluded assessment proceedings needs to be protected, and an assessee should be protected against undue harassment by the taxation authorities by resort to re-opening of the concluded assessment. However, when subsequently, it comes to light that the assessee has had financial/ monetary dealings with dubious entities/ persons – such as bogus accommodation entry providers, including of the kind noticed hereinabove, giving rise to a serious and well founded doubt about the creditworthiness of the investor and genuineness of the transaction, the endeavour of the Assessing Officer to re-open the assessment in terms of section 147/148 of the Act should normally not be thwarted by the Court, if the same is done within the limitation period, and the same is not merely a case of change of opinion on the same set of facts. A serious and well founded doubt about the genuineness of the transaction would justify formation of the reasonable belief that taxable income has escaped assessment in the light of the scheme of Section 68 of the Act, which provides that cash credits which, in the opinion of the Assessing Officer are not satisfactorily explained, would be charged to income tax as the income of the assessee. The subsequent acquisition of knowledge that the monetary transaction (including of the kind discussed above) undertaken by the assessee was with a bogus entity/ person-such as an accommodation entry provider – which knowledge was not available to the Assessing Officer at the time of completion of the scrutiny assessment, would be a material change of circumstances, and the formation of belief that taxable income has escaped assessment would not suffer from the taint of simplicitor change of opinion.

41. One cannot lose sight of the fact that once the proceedings are re- opened, the assessee would have full opportunity to meet the material/ evidence that the Assessing Officer may seek to rely upon to re-compute the taxable income in accordance with law. Moreover, an assessment order passed by the Assessing Officer would be open to challenge in appeal under the Act.

42. We may also refer to the decision in Chetan Sabharwal v. Assistant Commissioner of Income Tax, Circle 28 (1), W.P.(C.) No. 10897/2015 along with other connected petitions, decided on 06.08.2019. In the said decision, the Court, inter alia, held as follows:

41. As far as the case of Mr. Chetan Sabharwal is concerned, the original assessment orders for both AYs under Section 143(3) of the Act do not give any indication on the AO having formed any opinion whatsoever on the basis of which the reopening has been ordered. In this context the following observations in Income Tax Officer Ward No. 16 (2) v. Techspan India Pvt. Ltd. are relevant.

“18. Before interfering with the proposed reopening of the assessment on the ground that the same is based only on a change in opinion, the court ought to verify whether the assessment earlier made has either expressly or by necessary implication expressed an opinion on a matter which is the basis of the alleged escapement of income that was taxable. If the assessment order is non-speaking, cryptic or perfunctory in nature, it may be difficult to attribute to the assessing officer any opinion on the questions that are raised in the proposed reassessment proceedings. Every attempt to bring to tax, income that has escaped assessment, cannot be absorbed by judicial intervention on an assumed change of opinion even in cases where the order of assessment does not address, itself to a given aspect sought to be examined in the reassessment proceedings.”

42. Consequently, even in the cases of Mr. Chetan Sabharwal in view of the fact that the original assessment orders are totally silent on this aspect of the matter, it cannot be said that the reason to believe constitutes a “change of opinion‟.

43. At this juncture it must be stated that on a perusal of the report of the investigation which was produced before this Court, it appears prima facie that there was sufficient material to justify the reopening of the assessment in both sets of cases. Further, upon reading the reasons to believe as a whole the “live link”between the material in the form of the investigation report and the formation of belief that income that has escaped assessment is prima facie discernable. The Court hastens to add that this is a prima facie view which is all that is necessary at this stage.

44. The Court in this context would like to refer to the following observations of the Supreme Court in ITO v. Selected Dalurband Coal Limited (supra) where it was considering the effect of a letter of the Chief Mining Officer which emerged after the conclusion of the assessments:

“After hearing the learned Counsel for the parties at length, we are of the opinion that we cannot say that the letter aforesaid does not constitute relevant material or that on that basis, the Income- tax officer could not have reasonably formed the requisite belief. The letter shows that a joint inspection was conducted in the colliery of the respondent on January 9, 1967 by the officers of the Mining Department in the presence of the representatives of the assessee and according to the opinion of officers of the Mining Department; there was under reporting of the raising figure to the extend indicated in the said letter. The report is made by Government Department and that too after conducting a Joint inspection. It gives a reasonably specific estimate of the excessive coal mining said to have been done by the respondent over and above the figure disclosed by it in its returns. Whether the facts stated in the letter are true or not is not the concern at this stage. It may well be that the assessee may be able to establish that the fact stated in the said letter are not true but that conclusion can be arrived at only after making the necessary enquiry. At the stage of the issuance of the notice, the only question is whether there was relevant material, as stated above, on which a reasonable person could have formed the requisite belief. Since, we are unable to say that the said letter could not have constituted the basis for forming such a belief, it cannot be said that the issuance of notice was invalid. Inasmuch as, as a result of our order, the reassessment proceedings have now to go on we do not and we ought not to express any opinion on merits.”

(emphasis supplied)

43. As noticed herein above, the AO while making the regular assessment did not undertake the scrutiny that he could have undertaken in respect of the investment into the share capital of the petitioner by M/s Shail Investments Pvt. Ltd. and M/s New Delhi Credits Pvt. Ltd. Though the identity of the investor M/s Shail Investments Pvt. Ltd. and M/s New Delhi Credits Pvt. Ltd. may have been established, neither the financial capacity/ creditworthiness of the said investor companies, nor the genuineness of the transaction was examined. Since the two investor companies M/s Shail Investments Pvt. Ltd. and M/s New Delhi Credits Pvt. Ltd. have been found to be promoted by an accommodation entry provider, most certainly, there was reasonable cause for belief that the monies received by the petitioner from M/s Shail Investments Pvt. Ltd. and M/s New Delhi Credits Pvt. Ltd. may also be part of the bogus entries provided by them and, consequently, the taxable income of the petitioner had escaped the assessment.

44. The submission of learned counsel that the impugned notice and reasons suffer from non-application of mind, merely because the respondents have failed to take into consideration the fact that the earlier assessment was a scrutiny assessment, is neither here nor there. This is for the reason that the reasons for re-opening are detailed, and clearly bring out the justification and cause for re-opening. Moreover, when we see the original assessment order dated 07.07.2014, we find that there is absolutely no examination or discussion with regard to the genuineness of the transactions undertaken by the petitioner assessee with M/s Shail Investments Pvt. Ltd. and M/s New Delhi Credits Pvt. Ltd. during the Financial Year 2011-12. In view of the aforesaid discussion, and in the facts of the present case, reliance placed by learned counsel for the petitioner on Himson Textile Engineering Industries Ltd. (supra) and Bombay Stock Exchange Ltd. (supra) is completely misplaced. In CIT V Burlop Dealers Ltd., [1971] 79 ITR 609 (SC), the Supreme Court observed:

“having created and recorded bogus entries of loans, the assessee could not say that it had truly and fully disclosed all material fact necessary”.

45. Reliance placed on Haryana Acrylic Manufacturing Co. (supra) is also misplaced, for the reason that the petitioner/ assessee did not disclose that M/s Shail Investments Pvt. Ltd. and M/s New Delhi Credits Pvt. Ltd. are two companies promoted by Sh. Tarun Goyal, who has been established to be engaged in the business of providing accommodation entries through his 90 odd companies incorporated by him at the same set of address.

46. The revenue relied on Commissioner Of Income Tax, New Delhi vs. NDR Promoters Pvt. Ltd, (2019) 410 ITR 379 (Delhi), which is a judgment of this Court dated 17th January 2019 to come to the conclusion that M/S Shail Investments Pvt. Ltd. is a shell entity operated by Sh. Tarun Goyal, working from the premises 13/34, W.E.A. Karol Bagh, New Delhi, an address which is shared by numerous other bogus companies belonging to Sh. Tarun Goyal. Considering the above, this Court finds no merit in petitioner’s contention that M/S Shail Investment Pvt. Ltd. and M/S New Delhi Credits Private Limited have no nexus with Tarun Goyal, and that the said decision merely applies to M/S NDR Promoters and other bogus companies listed in the judgment. Merely because the two companies in question were not mentioned in the judgment, it does not mean that there can be no possible connection with Tarun Goyal. The list was not exhaustive, and fresh information was given to revenue that the two companies were controlled by Tarun Goyal from the same address of 13/34, W.E.A. Karol Bagh.

47. It would be beneficial at this juncture to refer to the judgment of this Court AGR INVESTMENT LTD. v. Additional Commissioner of Income Tax and Another, (2011) 333 ITR 146 (DELHI), where, similarly, specific information was received from office of the Directorate of Investigation that some transactions entered by assessee were accommodation entries and not genuine. The court while dismissing the petitioner’s request to quash the reassessment proceedings held that “it is neither a change of opinion nor does it convey a particular interpretation of a specific provision which was done in a particular manner in the original assessment and sought to be done in a different manner in the proceeding under Section 147 of the Act. The reason to believe has been appropriately understood by the assessing officer and there is material on the basis of which the notice was issued.”

48. In Pankaj Hospital Ltd. v. Commissioner of Income tax, (2014) 44 taxman. Com 230 (All), the Division Bench of Allahabad High Court was faced with similar facts, and information was received about the same Tarun Goyal who was providing accommodation entries to beneficiary companies. The court held:

“Now, it is true that during the course of the assessment proceedings, the Assessing Officer had required the assessee to disclose information pertaining to the share applicants, the amounts and their source, the mode in which payment was made and confirmatory letters together with PAN details. For the purpose of these proceedings, the Court must proceed on the basis of the reply furnished by the assessee to the notice under Section 142(1). The assessee had indicated the names of the companies, their addresses, the application money, date of payment, mode of payment and PAN details. But it is also trite law that for such cases three important aspects have to be considered by the Assessing Officer, namely (i) the identity of the investors; (ii) the credit worthiness of the applicants; and (iii) the genuineness of the transaction.

Ex-facie, the order of assessment which was passed by the Assessing Officer under Section 143(3) on 2 December 2008 does not indicate that the Assessing Officer had brought his mind to bear on either of these aspects. In fact there is nothing in the reply filed by the assessee to the notice under Section 142(1) that would indicate a full disclosure of facts in regard to either the credit worthiness of the companies which made the investments or the genuineness of the transaction. A cloud was cast on the genuineness of the transaction once a search took place at the premises of the Chartered Accountant who, according to the Department, has stated that he had set up 90 bogus companies, all within his control and in which the Directors were his own employees only for the purpose of providing accommodation entries in favour of various beneficiaries. Among the beneficiaries is the petitioner to whom a payment of Rs.2.21 crores was made through the four companies which created a conduit. Whether it is actually so, is a matter of fact which would have to be determined in the course of the proceedings after the assessment is reopened. At this stage, the only issue before the Court is to whether there was reason to believe that any income chargeable to tax had escaped assessment. From the reply which was furnished by the assessee during the course of the assessment proceedings, it does not emerge that the assessee had discharged the onus of establishing the credit worthiness of the companies which had ostensibly invested the amount or in regard to the genuineness of the transaction. Hence, though the reopening of the assessment in the present case is beyond the period of four years but the Assessing Officer was satisfied that the condition stipulated in the first proviso to Section 147 was duly fulfilled”

49. Considering the circumstances and arguments raised, we find that the order of the Assessing Officer and notice issued under Section 148 read with Section 147 is not illegal.

50. We, therefore, do not find any merit in this petition and dismiss the same, while making it clear that the Assessing Officer shall not be influenced by our aforesaid observations while framing the re-assessment order and he shall proceed independently on the basis of the evidences and other materials brought on his record.

51. As noticed herein above, learned counsel for the petitioner continued to pursue with his submissions despite this Court informing him, after the matter had been heard at substantial length, that this Court does not find any merit in the petition. This has led to absolutely unnecessary wastage of time of this Court which was avoidable, and could have been utilized to deal with other deserving and pressing cases. To discourage such practice, we are inclined to saddle the petitioner with costs which are quantified at Rs. 2 lakhs. The costs shall be payable to The Delhi High Court Advocates Welfare Trust. A copy of this order be communicated to the aforesaid trust. In case the costs are not deposited within four weeks of the receipt of the copy of this order, the matter may be brought to the notice of this Court by the trustees or their representatives.

To Download Copy of Order – Click Here

For Regular Updates Join : https://t.me/Studycafe

Tags : Judgement, High Court

The post S. 147 Reopening for taxing bogus share application money appeared first on Studycafe.

from Studycafe https://ift.tt/2MI5gYk