News Alert For Tax Payers – CGST Rule 86A, Blockage of ITC credit

Govt has imposed restriction on using of ITC credit available in Electronic Credit Ledger on GSTN Portal vide Ntf no. 75/2019(Central Tax) dtd. 26.12.2019.

Rule 86A empowers taxman to impose restrictions on use of available Input Tax Credit in case he has reasons to believe that credit of input tax available in the electronic credit ledger has been fraudulently availed or is ineligible as per CGST Act.

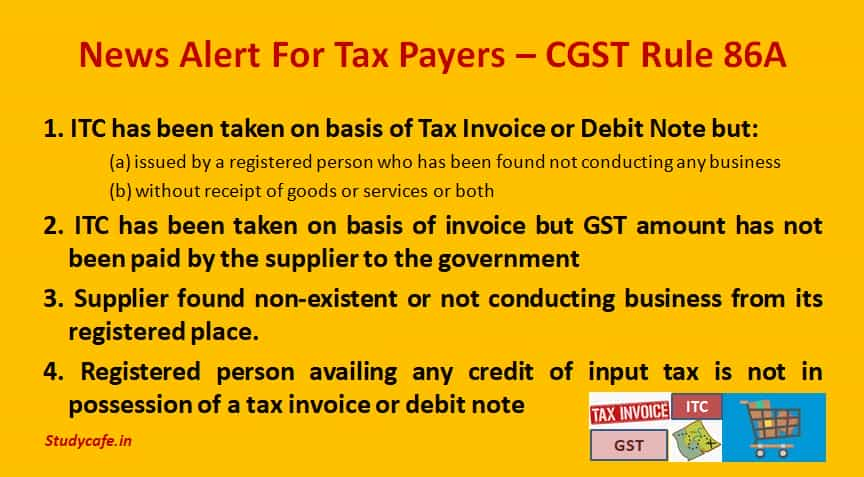

In which situation Taxman can block my ITC Credit?

Taxman can block my ITC Credit when he find that:

1. ITC has been taken on basis of Tax Invoice or Debit Note but:

(a) issued by a registered person who has been found not conducting any business

(b) without receipt of goods or services or both

2. ITC has been taken on basis of invoice but GST amount has not been paid by the supplier to the government

3. Supplier found non-existent or not conducting business from its registered place.

4. Registered person availing any credit of input tax is not in possession of a tax invoice or debit note

What is the process of blocking GST ITC by GST Officer?

If Commissioner or an officer authorised by him in this behalf, not below the rank of an Assistant Commissioner,

- have reasons to believe that credit of input tax available in the electronic credit ledger has been fraudulently availed,

- or above mentioned conditions are fulfilled, then

The GST Officer will give order in writing and will block the GST input tax credit of Tax Payer. As a result, the taxpayer will not be able to use blocked input tax credit.

In such case taxpayer cannot claim of any refund of any unutilised amount as well.

Unblocking GST ITC by GST Officer

In case Taxpayer submit proof/Documentary evidence of his innocence and the GST Officer is satisfied that conditions for disallowing debit of electronic credit ledger as above, no longer exist, he may unblock the ITC, which can then be used by the taxpayer.

Is there any time limit of such restriction?

Such restriction shall cease to have effect after the expiry of a period of one year from the date of imposing such restriction

Clarifications required!

- As of now mechanism of blocking credit on GST Portal has not been notified.

- As per rule, such restriction will cease to exist after one year. Does that mean that the taxpayer can take ITC benefit after one year even if he is guilty.

For Regular Updates Join : https://t.me/Studycafe

Tags : GST, Electronic Credit Ledger, Rule 86A

The post News Alert For Tax Payers – CGST Rule 86A, Blockage of ITC credit appeared first on Studycafe.

from Studycafe https://ift.tt/2tj4mKN

No comments:

Post a Comment