Presentation made by Revenue Secretary on major initiatives taken on taxation

Refund of taxes

New Refund System (GST)

• Completed Automated Refund Process implemented from 26.09.2019:

• Online filing of refund application (including uploading of supporting documents)

• Online processing, sanction and disbursement in the Bank account

• Single Source Disbursement of Refund:

• The complete refund amount under the head of IGST, CGST, SGST and Cess to be disbursed by Centre

Recent initiatives on simplification of GST

•Introduction of e- invoicing

•From 1.01.2020, it will be optional for all taxpayers with turnover more than Rs. 500 Crores will have to generate E Invoice for all the B2B transactions.

•From 1.04.2020, it will be compulsory for all taxpayers with turnover more than Rs. 100 Crores will have to generate E-Invoice for all the B2B transactions.

•Once E-Invoice is generated all future returns for the taxpayer will be automatically populated.

•In future, E-Way Bill will not be needed for E-Invoices

Compliance Simplification and feedback

• For FY 2017-18 and 2018-19, Annual Return and Reconciliation Statement has been made optional for taxpayers less than Rs. 2 Crore

• For FY 2017-18 and 2018-19, many of the prominent fields have made optional for taxpayers in Annual Return and Reconciliation statement

• A “Stakeholder Feedback Diwas” drive was organized on 07.12.2019 in around 193 cities where 19645 stakeholders participated.

•Document Identification Number (DIN): From 08.11.2019, DIN has been made mandatory for following activities:

a. all search authorisations, summons, arrest memo,

b. inspection notices and letters issued by tax authorities

• Refund Drive:

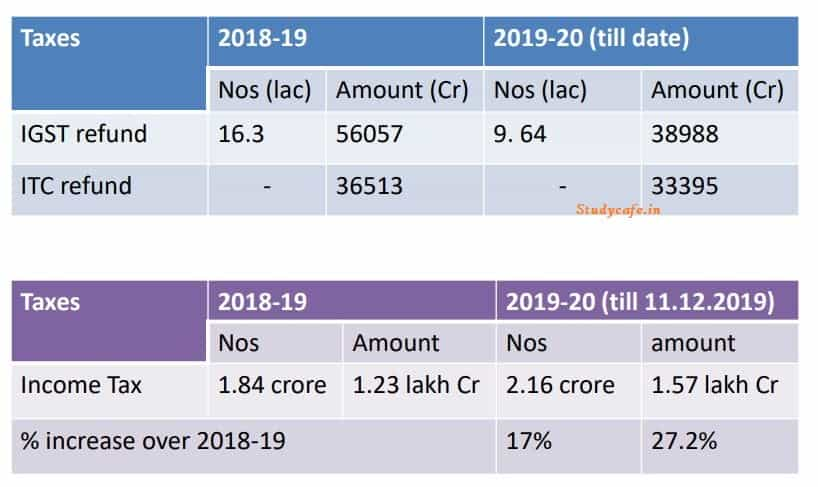

To clear pending refund of MSME a drive was under taken in the month of September- 2019 in which following amounts were sanctioned

• Sabka Viswas- legacy dispute resolution scheme: till 31.12.2019

Major initiatives in the Direct Taxes

Legislative measures Post-budget

• Reduction in CT rate for all existing companies: An existing domestic company can opt to pay tax at 22% (i.e. effective tax rate of 25.17%) as against the existing highest effective CT rate of 34.94 if it does not claim any tax exemption/ deduction-No MAT for these companies.

• Reduction in CT rate for new manufacturing companies: A new domestic manufacturing company can pay tax at 15% (i.e. effective tax rate of 17.16%) if it does not claim any tax exemption/ deduction- No MAT for these companies.

• Reduction in rate of Minimum Alternate Tax (MAT): The rate of MAT for the other companies has also been reduced from 18.5% to 15%.

• Grand-fathering of Buy-back provisions: The buy-back announced on or before 5th July, 2019 were exempted from the Buy-back tax.

• Relief from enhanced surcharge in certain cases: The enhanced surcharge was removed for capital gains on transfer of listed equity share/certain units and also for capital gains income of FPIs from securities trading.

• Enhanced depreciation for Auto sector: The rates of depreciation was increased by 15% for new motor vehicles.

Ease of compliance

• Faceless assessment: In order to reduce the interface between the taxpayer and tax officers, faceless assessment has been launched on 7th October, 2019-Total number of cases to be assessed under the scheme is 58,322 – Questionnaire in the faceless manner has already been issued in 19883 cases.

• Document Identification Number (DIN): From 01.10.2019, it has been made mandatory for all notices/summons/orders etc. issued by the income-tax authorities shall have DIN – 6.42 crore communications with DIN has already been issued by the Department.DIN_Notice.pdf

• Simplification of compliance norms for Start-ups: start-ups have been provided hassle-free tax environment which incudes simplification of assessment procedure, exemptions from Angel-tax, constitution of dedicated start-up cell.

• Reduction in Litigation: The monetary limit for filing of departmental limit has been enhanced by 100-150 %-more than 13,000 appeals have been withdrawn by the Department after the enhancement.

• Prefilling of ITRs: Pre-filled returns provided to more than 2 crore salaried taxpayers for AY 2019-20.

• Speedy Issuance of Refunds: There is significant growth in the issuance of refund by the Department-the amount of refund has increased by 27.2% and the number of refunds has increased by 17%. The total amount of refund issued in this Financial year till 11.12.2019 is Rs. 1.57 lakh crores as against Rs. 1.23 lakh crore in the corresponding period of FY 2018-19.

• Relaxation in the norms for Prosecution: In order to provide relief to taxpayers for small violations, it has been provided that the sanctioning authority of prosecution has to take approval of a collegium of two CCIT/DGIT rank officers for launching of prosecution in most of the cases except where the default exceeds Rs. 25 Lakhs in case of non-payment of TDS, wilful evasion of tax or failure to file return.

For Regular Updates Join : https://t.me/Studycafe

The post Presentation made by Revenue Secretary on major initiatives taken on taxation appeared first on Studycafe.

from Studycafe https://ift.tt/36uFiiq

No comments:

Post a Comment