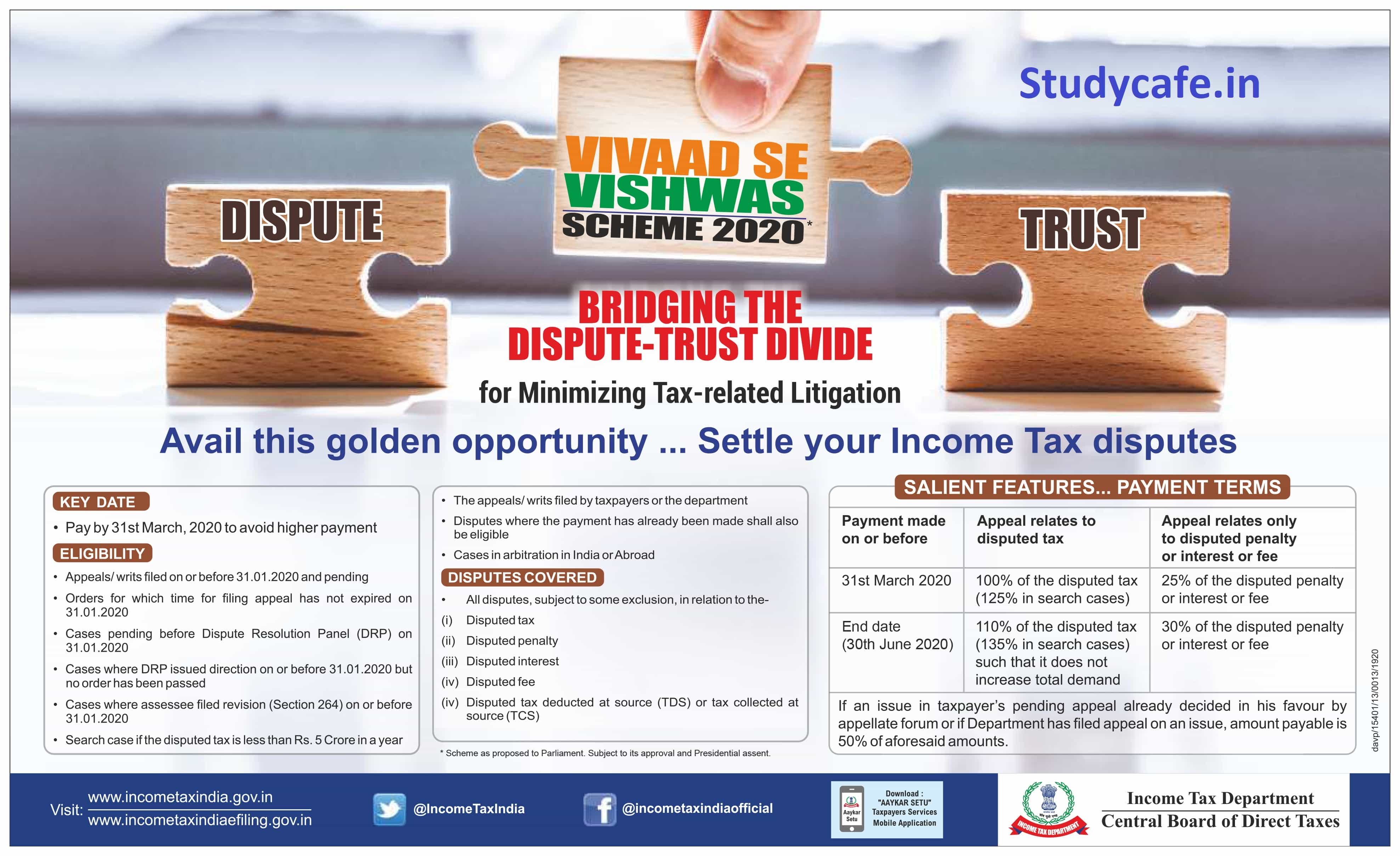

VIVAAD SE VISHWAS SCHEME 2020 – INCOME TAX

KEY DATE

• Pay by 31st March, 2020 to avoid higher payment ELIGIBILITY

ELIGIBILITY

- Appeals/writs filed on or before 31.01.2020 and pending

- Orders for which time for filing appeal has not expired on 31.01.2020

- Cases pending before Dispute Resolution Panel (DRP) on 31.01.2020

- Cases where DRP issued direction on or before 31.01.2020 but no order has been passed Cases where assessee filed revision (Section 264) on or before 31.01.2020

- Search case if the disputed tax is less than Rs. 5 Crore in a year

- The appeals/ writs filed by taxpayers or the department

- Disputes where the payment has already been made shall also be eligible

- Cases in arbitration in India or Abroad

DISPUTES COVERED IN SCHEME

- All disputes, subject to some exclusion, in relation to the

(i) Disputed tax

(ii) Disputed penalty

(iii) Disputed interest

(iv) Disputed fee

(iv) Disputed tax deducted at source (TDS) or tax collected at source (TCS)

SALIENT FEATURES : PAYMENT TERMS

| Payment made on or before | Appeal relates to disputed tax | Appeal relates only to disputed penalty or interest or fee |

| 31st March 2020 | 100% of the disputed tax (125% in search cases) | 25% of the disputed penalty or interest or fee |

| End date (30th June 2020) |

110% of the disputed tax (135% in search cases) such that it does not increase total demand | 30% of the disputed penalty or interest or fee |

If an issue in taxpayer’s pending appeal already decided in his favour by appellate forum or if Department has filed appeal on an issue, amount payable is 50% of aforesaid amounts.

Source : Income Tax

The post VIVAAD SE VISHWAS SCHEME 2020 – INCOME TAX appeared first on Studycafe.

from Studycafe https://ift.tt/2uxHmZN

No comments:

Post a Comment