Direct Tax Vivad se Vishwas Rules & Forms notified by CBDT

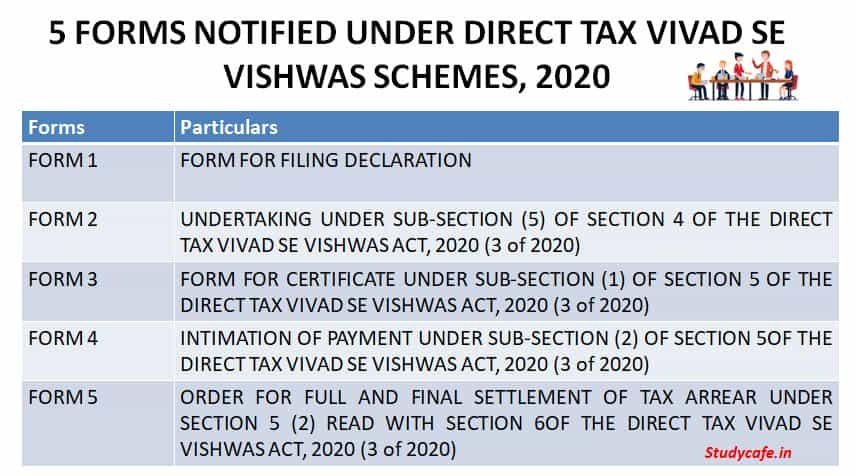

Direct Tax Vivad se Vishwas Rules, 2020 and Forms have been notified by Ministry of Finance. 5 Forms have been notified under this Scheme. The Direct Tax Vivad Se Vishwas Act, 2020 has received the president assent on March 17, 2020. As of now, time-line for payment of 100% of disputed tax with complete waiver of interest and penalty is also 31st March 2020.

This scheme will give a one time opportunity to those taxpayer in whose case an appeal is pending against disputed tax amount, interest chargeable on disputed tax.

1. To pay whole of the disputed tax amount only before 31 Mar’2020 without requiring them to pay interest, fee or fine on it.

Or

2. To pay whole of the disputed tax plus 10% of the disputed tax only, where the payment is made after 31 Mar 2020 but before 30 June 2020 without requiring them to pay interest, fee or fine on it.

This bill will give an opportunity to those taxpayer as well in whose case an appeal is pending against disputed penalty, interest or fee amount

1. To pay 25% of the disputed penalty, interest or fee amount before 31 Mar’2020

or

2. To pay 30% of the disputed penalty, interest or fee amount, where the payment is made after 31 Mar 2020 but before 30 June 2020.

Click here to download the rules

The post Direct Tax Vivad se Vishwas Rules & Forms notified by CBDT appeared first on Studycafe.

from Studycafe https://ift.tt/3b6e0Bg

No comments:

Post a Comment