ESIC & EPF RELIEF SCHEME GUIDELINES 2020 DUE TO COVID19

Pradhan Mantri Garib Kalyan Yojana: A Scheme to implement the PMGKY package for credit of employee’s & employer’s share of EPF & EPS contributions (24% of wages) for three months by Govt. of India.

• Overview:

The Govt. of India on 26.03.2020 relief package under Pradhan Mantri Garib Kalyan Yojana (PMGKY) and the Central Govt. proposes to pay 24 % of the monthly wages into EPF accounts for next three months of Wage-earners below Rupees 15,000/- per month, who are employed in establishments having up to one hundred employees, with 90% or more of such employees earning monthly wages less than Rs.15000/-

• Validity of Scheme: The Scheme will be in operation for the wage months- March, 2020, April, 2020 and May, 2020.

• Scheme Objectives

- To support establishments employing up to one 100 employees,

- the entire employees EPF contributions (12% of wages) and employers’ EPF & EPS contribution (12% of wages), totaling 24% of the monthly wages for the next three months shall be directly paid by the Central Govt. in the EPF accounts (UAN) of employees, who :

- are already members of EPF Scheme, 1952,

- drawing wages less than Rs.15000/- per month and

- employed in establishments, already covered under the EPF & MP Act, 1952,

- employing up to 100 employees, with 90% or more of such employees earning less than Rs.15,000/- monthly wages.

• Definitions for the Scheme

The definitions mentioned in various sub-sections of section 2 of The Employees’ Provident Fund & Misc. Provisions Act, 1952 and Para 2 of the Employees’ Provident Funds Scheme, 1952, would be applicable mutatis mutandis to this scheme as well.

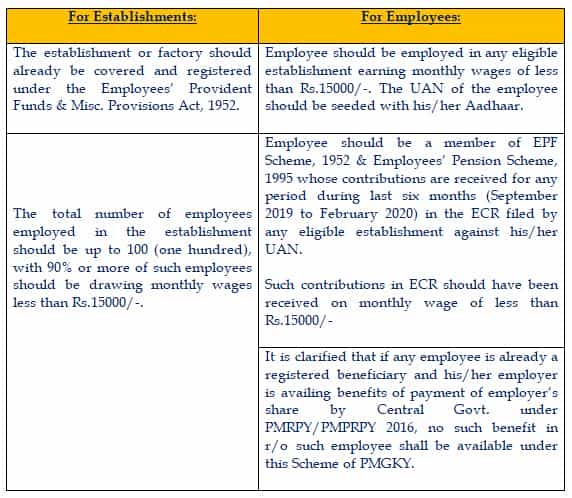

• Eligibility for Scheme benefits:

• Modalities for implementation of the Scheme

- EPFO shall develop a software for implementing this Scheme and also develop a procedure which is transparent and accountable at their own end.

- EPFO shall credit the funds in the Aadhaar seeded accounts of members of EPF in electronic manner.

• Monitoring Mechanism

- EPFO shall put in place a robust mechanism to monitor the implementation of the Scheme on a daily basis.

- EPFO shall provide weekly reports to the Ministry of Labour & Employment (Directorate General of Employment), Govt. of India for effective monitoring of the Scheme.

• Third Party evaluation

- EPFO shall undertake Third Party Evaluation of the Scheme within a period of three months from the closure of the Scheme and send a report to the Ministry of labour & Employment, Govt. of India.

- The expenditure incurred towards evaluation of the Scheme shall be borne by the EPFO out of its own resources.

Click Here to Download the Order

Disclaimer:

IN NO EVENT THE AUTHOR SHALL BE LIABLE FOR ANY DIRECT, INDIRECT, SPECIAL OR INCIDENTAL DAMAGE RESULTING FROM OR ARISING OUT OF OR IN CONNECTION WITH THE USE OF THIS INFORMATION.

You May Also Refer:

FAQS EPF & EPS Contributions relief to low wage earning employees

The post ESIC & EPF RELIEF SCHEME GUIDELINES 2020 DUE TO COVID19 appeared first on Studycafe.

from Studycafe https://ift.tt/3efT79a

No comments:

Post a Comment