TCS provisions applicable from 1st Oct 2020- Discussion & FAQs

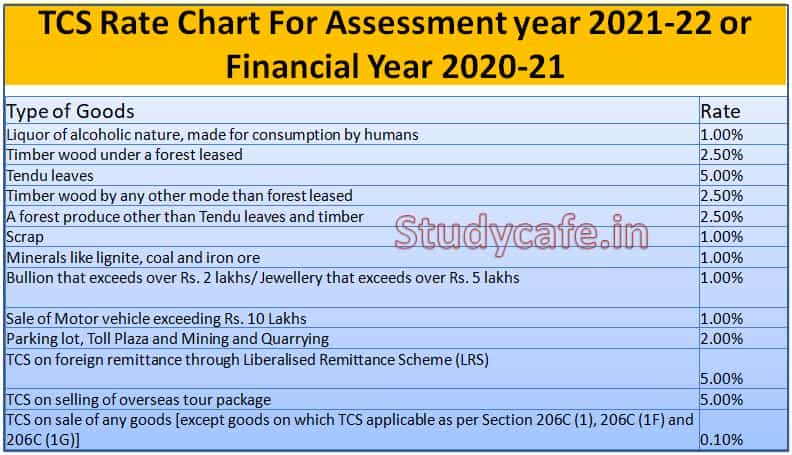

Through this article, we shall discuss the new TCS provisions in Finance Act 2020. Finance Act 2020 has come up with provisions of Section 206C(1G)(a) – TCS on foreign remittance through Liberalised Remittance Scheme, Section 206C(1G)(b) – TCS on selling of overseas tour package, Section 206C(1H) – TCS on sale of goods over a limit [Not Applicable if the seller is liable to collect TCS under other provision of section 206C]. Through his Acticle we shall discuss these three provisions so that readers can get some clarity in his respect. The Article Also contains, TCS Rate Chart For Assessment year 2021-22 or Financial Year 2020-21.

You May Also Refer: TDS/TCS Provisions and Compliance Income Tax Act 1961 Chapter XVII

Please note that the new provisions of TCS are applicable with effect from 1st October 2020. So now lets discuss on the TCS provisions applicable from 1st Oct 2020.

Section 206C(1G)(a) – TCS on foreign remittance through Liberalised Remittance Scheme

Applicability: Applicable on an authorised dealer receiving an amount or an aggregate of amounts of Rs. 7 lakh or more in a financial year for remittance out of India under the LRS of RBI.

TCS Rate: He shall be liable to collect TCS at the rate of five per cent.

Libility shall occur if sum recieved is in excess of Rs. 7 lakh.

• In non PAN/Aadhaar cases the rate shall be ten per cent.

Non Applicability of Above Provision

• The above TCS provision shall not apply if the buyer is,-

a. liable to deduct tax at source under any other provision of the Act and he has deducted such amount.

b. the Central Government, a State Government , an embassy, a High Commission, legation, commission, consulate, the trade representation of a foreign State, a local authority as defined in Explanation to clause (20) of section 10 or any other person notified by the Central Government.

Definition of “Authorised dealer”

“Authorised dealer” is proposed to be defined to mean a person authorised by the Reserve Bank of India under sub-section (1) of section 10 of Foreign Exchange Management Act, 1999 to deal in foreign exchange or foreign security.

Example of TCS on foreign remittance through Liberalised Remittance Scheme

| Date | Transaction | TCS Applicability |

| 01/11/2020 | Rs. 300,000 | Not Applicable |

| 12/12/2020 | Rs. 500,000 | Yes Applicable on Rs. 100,000 (Rs. 8,00,000 – Rs. 300,000) |

| 13/01/2021 | Rs. 200,000 | Yes Applicable on Rs. 200,000 |

You May Also Refer: TDS Rate Chart for FY 2020-21 or TDS Rates for AY 2021-22

Section 206C(1G)(b) – TCS on selling of overseas tour package

Applicability: Applicable on seller of an overseas tour program package who receives any amount from person who purchases such package

TCS Rate: He shall be liable to collect TCS at the rate of five per cent.

• In non-PAN/ Aadhaar cases the rate shall be ten per cent.

Non Applicability of Above Provision

• The above TCS provision shall not apply if the buyer is,-

a. liable to deduct tax at source under any other provision of the Act and he has deducted such amount.

b. the Central Government, a State Government , an embassy, a High Commission, legation, commission, consulate, the trade representation of a foreign State, a local authority as defined in Explanation to clause (20) of section 10 or any other person notified by the Central Government.

Definition of “Overseas tour program package”

“Overseas tour program package” is proposed to be defined to mean any tour package which offers visit to a country or countries or territory or territories outside India and includes expenses for travel or hotel stay or boarding or lodging or any other expense of similar nature or in relation thereto.

Section 206C(1H) – TCS on sale of goods over a limit

• Section Not Applicable if the seller is liable to collect TCS under other provision of section 206C.

Applicability: A seller of goods is liable to collect TCS at the rate of 0.1 per cent on consideration received from a buyer in a previous year in excess of Rs. 50 lakh.

• In non-PAN/ Aadhaar cases the rate shall be one per cent.

• Only those seller whose total sales, gross receipts or turnover from the business carried on by it exceed Rs. 10 crore rupees during the financial year immediately preceding the financial year, shall be liable to collect such TCS.

Non Applicability of Above Provision

• No TCS is to be collected from the Central Government, a State Government and an embassy, a High Commission, legation, commission, consulate, the trade representation of a foreign State, a local authority as defined in Explanation to clause (20) of section 10 or any other person as the Central Government may, by notification in the Official Gazette, specify for this purpose, subject to conditions as prescribed in such notification.

• No such TCS is to be collected, if the seller is liable to collect TCS under other provision of section 206C or the buyer is liable to deduct TDS under any provision of the Act and has deducted such amount.

Example of TCS on sale of goods

Whether TCS is applicable on GST Portion as well?

No, TCS is not applicable on GST Portion

| Particulars | When PAN or Aadhaar is provided | When PAN or Aadhaar is not provided |

| Sale Value | Rs. 5100000 | Rs. 5100000 |

| GST @ 5% | Rs. 255000 | Rs. 255000 |

| TCS | Rs. 5100 (TCS @ 0.1%) | Rs. 51000 (TCS @ 1%) |

| Net Payable | Rs. 5349900 | Rs. 5304000 |

TCS Rate Chart For Assessment year 2021-22 or Financial Year 2020-21

The post TCS provisions applicable from 1st Oct 2020- Discussion & Analysis appeared first on Studycafe.

from Studycafe https://ift.tt/39Fr5jG

No comments:

Post a Comment