How to do Online Correction of TDS Challan

Important Information on Online Correction

All type of corrections like “Personal information , Deductee details and Challan correction” can be made using Online correction functionality available from FY.2007-08 onwards depending upon the type of correction

This feature is extremely useful as it is :

Free of Cost : TRACES does not charge any fee for doing online correction

Time saving: No need to request for Conso file and wait for file availability. Just raise a request and you can select the type of correction you wish to proceed with. Correction gets processed in 24hrs

Effort saving: No need of any software/ CD/PEN drive , just login and file the correction

Enhance efficiency: Error specific correction is possible

Note: For paper return online correction cannot be done

Most Common Error While filing Online Correction

Most Common Error While filing Online Correction (Contd.)

Brief Steps for Online Correction – Resolution for Overbooked Challan (Movement of deductee row)

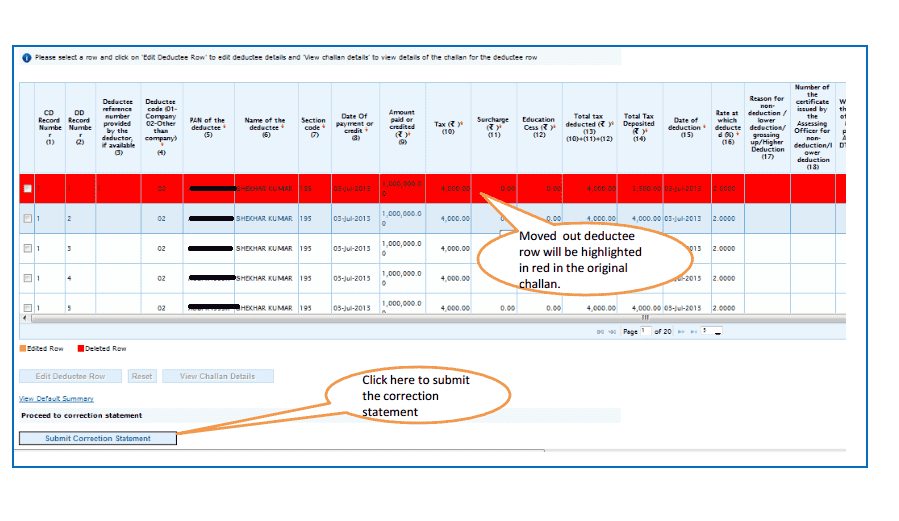

• This feature enables deductor to move deductee rows from one challan to another challan having balance in correction statement

• For example, If Challan 1 gets overbooked by Rs. 10000 and challan 2 is available with balance of INR10000 or more, Deductor can easily move overbooked deductee rows upto INR 10000 from challan 1 to Challan 2 by filing online challan correction

• Step 1 : Login to TRACES website

• Step 2 : Go to “Request for correction” under “ Defaults“ by entering relevant Quarter,Financial Year, Form Type , Latest Accepted Token number

• Correction category should be “Online”

• Request number will be generated

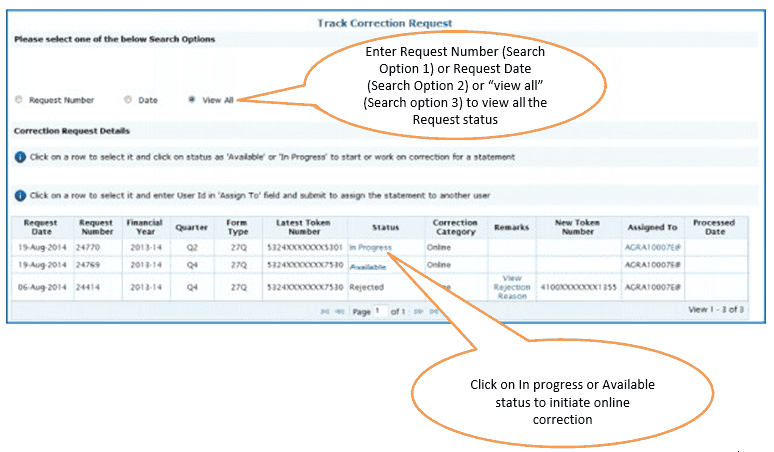

• Step 3 : Request will be available under “ Track Correction Request”

• When request status become “Available” click on Available / In progress status to proceed with the correction

• Provide information of Valid KYC

• Step 4 : Select the type of correction category from the drop down as “Resolution for Overbooked Challan (Movement of deductee row)”

• Step 5 : Make the required corrections in the selected file

• Step 6 : Click on “Submit for Processing” to submit your correction (Only Available to Admin User)

• Step 7 : 15 digits token number will be generated and mailed to Registered e-mail ID

Status of Online Correction Requests:

• Requested – When user submits request for correction.

• Initiated – Request is being processed by TDS CPC

• Available – Request for correction is accepted and statement is made available for correction. User can start correction on the statement. Clicking on the hyperlink will take user to validation screen. Once user clicks on request with ‘Available’ status, status of request / statement will change to ‘In Progress’

• Failed – Request cannot be made available due to technical error. User can re-submit request for same details

• In Progress – User is working on a statement. Clicking on the hyperlink will take user to validation screen

• Submitted to Admin User – Sub-user / Admin User has submitted correction statement to Admin User

• Submitted to ITD – Admin User has submitted correction statement to ITD for processing

• Processed – Statement has been processed by TDS CPC (either for Form 26AS or for defaults)

• Rejected – Statement has been rejected by TDS CPC after processing. Rejection reasons will be displayed in ‘Remarks’ column

Login to TRACES

Welcome Page

Online Correction Request Flow

Online Correction Request Flow

Online Correction Request Flow

Online Correction Request Flow

Online Correction Request Flow– View submitted request

Available Status – Request for correction is accepted and statement is made available for correction. User can start correction on the statement. Clicking on the hyperlink will take user to validation screen. Once user clicks on request with ‘Available’ status, status of request / statement will change to ‘In Progress‘

In Progress Status- User is working on a statement. Clicking on the hyperlink will take user to validation screen

Digital Signature supported KYC Validation contd. (Step 1)

• Digital Signature Support KYC validation screen will appear only if Digital Signature is registered. Deductor can register/re register their Digital Signature in Profile. Please refer – Digital Signature Certificate Registration e-Tutorial for more information.

• Normal KYC Validation (without Digital Signature) – User can opt a normal KYC validation separately for each functionality without digital signature.

Digital Signature supported KYC Validation contd. (Step 2 & 3)

Digital Signature supported KYC Validation contd. (Step 4 & 5)

Digital Signature supported KYC Validation contd. (Step 6 & 7)

Digital Signature supported KYC Validation contd. (Step 8)- KYC of the FY + Quarter + Form Type selected in Step 2 will be displayed

• Authentication Code will not appear on the screen in case DSC Supported KYC

• In one session this manual KYC page ( On the basis of input selected by the user ) will be displayed only once

Token Number Details (Contd.)

Notes for Validation Screen:

• Authentication code is generated after KYC information details validation, which remains valid for the same calendar day for same form type, financial year and quarter

• Token Number must be of the regular statement of the FY, Quarter and Form Type displayed on the screen

• CIN/BIN details must be entered for the challan/book entry mentioned in the statement corresponding to the FY, Quarter and Form Type mentioned above

• Government deductor can enter only Date of Deposit and Transfer Voucher amount mentioned in the relevant Statement

• Amount should be entered in two decimal places (e.g., 1234.56)

• Only Valid PAN(s) reported in the TDS/TCS statement corresponding to the CIN/BIN details in Part1 must be entered in Part 2 of the KYC. Guide available on the screen can be referred for valid combinations.

• Maximum of 3 distinct valid PANs and corresponding amount must be entered

• If there are less than three such combinations in the challan, user must enter all (either two or one)

• CD Record no. is mandatory only in case of challan is mentioned more than once in the statement

Authentication Code Screen

Challan Correction – Movement of deductee row

Challan Correction – Overbooked Challan

Movement of deductee row – Matched Challan

Movement of deductee row – Matched Challan

List of challan with available balance in the statement will be displayed

Movement of deductee row – Matched Challan

Movement of deductee row – Matched Challan

Movement of deductee row – Matched Challan

Action Summary

Action Summary

Action Summary –Submit to Admin User

Above Screen will be appeared in case correction submitted by Sub-user

Action Summary

Request will be submitted to Admin user . Sub-user cannot submit the correction from ‘ Correction Ready for Submission’.

Sub-user should only be able to view statements saved by them

Action Summary-View Edited Statement

Both Admin User and Sub-user can able to view statements saved by them

Action Summary-Admin User Login

Action Summary-Admin User Login

Action Summary-Admin User

Action Summary-Submit For Processing

Admin User needs to attached the digital signature and submit the correction

Action Summary – Attached Digital Signature

Action Summary –Token Number Generated

Note: Note down the Token Number for future reference

Tags: Income Tax, TDS

How to Register and Update Digital Signature (DSC) on GST Portal / Website

The post How to do Online Correction of TDS Challan appeared first on Studycafe.

from Studycafe https://ift.tt/2Wb8KYz

No comments:

Post a Comment