GST Rates under GST Composition Scheme amended by GST

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central Board of Indirect Taxes and Customs

Notification No. 50/2020 – Central Tax

New Delhi, the 24th June, 2020

G.S.R (E). – In exercise of the powers conferred by section 164 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government, on the recommendations of the Council, hereby makes the following rules further to amend the Central Goods and Services Tax Rules, 2017, namely:-

1. (1) These rules may be called the Central Goods and Services Tax (Seventh Amendment) Rules, 2020.

(2) They shall come into force with effect from the 01st day of April, 2020.

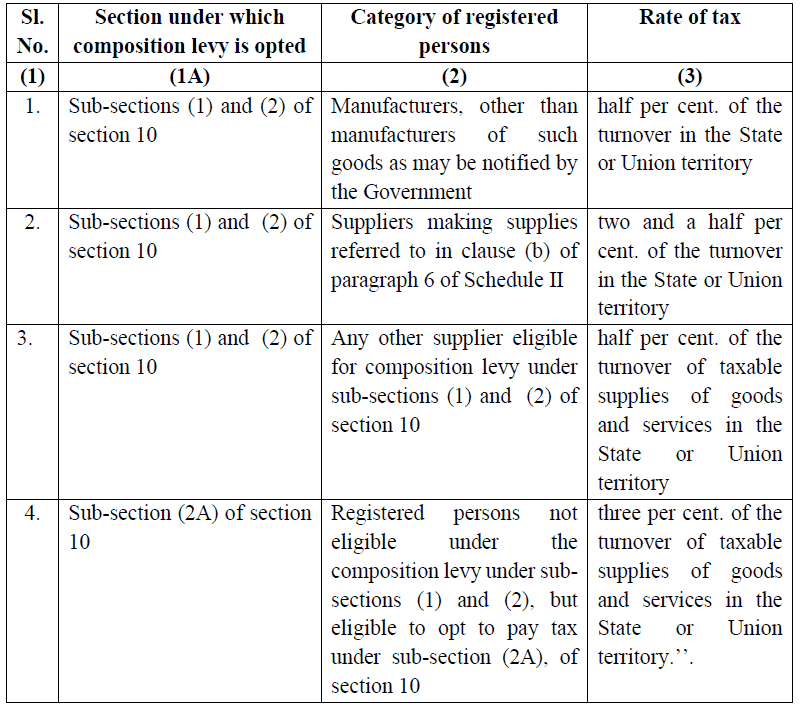

2. In the Central Goods and Services Tax Rules, 2017, in rule 7, for the Table, the following Table shall be substituted, namely:-

Table

[F. No. CBEC-20/06/09/2019-GST]

(Pramod Kumar)

Director, Government of India

Note: The principal rules were published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide notification No. 3/2017-Central Tax, dated the 19th June, 2017, published vide number G.S.R. 610(E), dated the 19th June, 2017 and last amended vide notification No. 48/2020 – Central Tax, dated the 19th June, 2020 published vide number G.S.R. 394 (E), dated the 19th June, 2020.

Tags : GST, GST Notifications

You May Also Like :

- COUNTER STROKE ON DARK SIDE OF E-COMMERCE (TAX EVASION)

- CBIC Clarification on GST Refund matters & GSTR 7

- FORM GST MOV -11 : ORDER OF CONFISCATION OF GOODS AND CONVEYANCE

The post GST Rates under GST Composition Scheme amended by GST appeared first on Studycafe.

from Studycafe https://ift.tt/3hZtg7n

No comments:

Post a Comment