Statutory Compliance calender June 2020

Statutory Compliance: Due Date Fall under June 2020

This Article compiles due dates of compliance related to GST Act 2017, Income Tax Act 1962, ESI, PF Acts which includes compliance related to GSTR-1, GSTR-3B, GSTR-5 & 5A, GSTR-6, GSTR-7, GSTR-8, Due dates for payment of TDS / TCS, Dues date for Payment of Advance Tax, Due date for Issue of TDS/ TCS Certificates, Due date for linking of Aadhaar number with PAN, Due date for payment of PF / ESIC .

1. Due Dates for Compliance under GST Act 2017

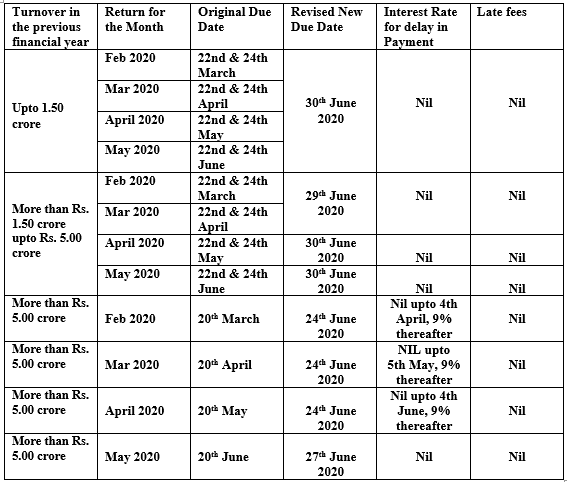

i) Due Dates for GSTR-3B

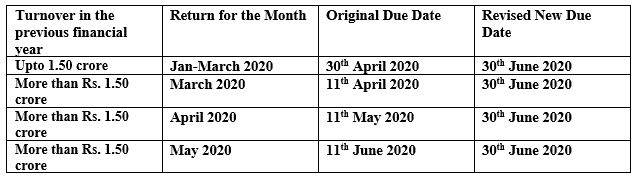

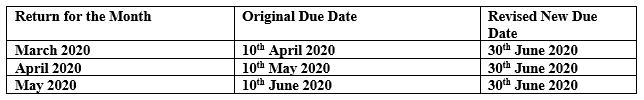

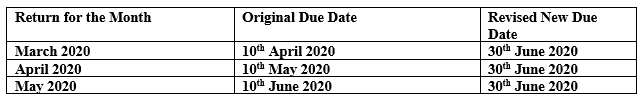

ii) Due Dates for GSTR-1

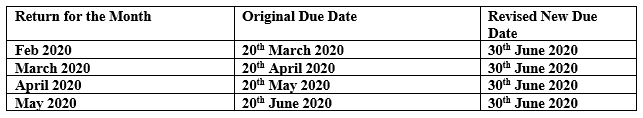

iii) Due Dates for GSTR-5 &5A (to be filed by the Non-Resident taxable person & OIDAR)

iv) Due Dates for GSTR-6 (to be filed by Input Service Distributor)

v) Due date for filing GSTR-7 (to be filed by the by the person who is required to deduct TDS under GST)

vi) Due date for filing GSTR-8 (to be filed by the by the by the E-commerce operators required to deduct TDS under GST)

2. Due Dates for Compliance under Income Tax Act 1961

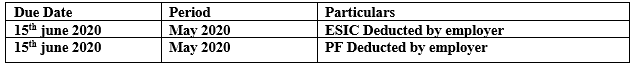

3. Due Dates for Compliance under ESI Act 1948

Disclaimer :

This information is shared by author only for knowledge purposes. In no event the author shall be liable for any direct, indirect, special, or incidental damage resulting from or arising out of or in connection with the use of this information.

Compiled By : CA AMRISH AGGARWAL

Email Id : Amrish.aggarwal 001@gmail.com

Tags : Company Law

You May Also Like :

- MSME New Definition Applicable w.e.f 01st July 2020 Notified by MSMED

- Corporate Compliance Calendar for the Month of April 2020

- Tax planning through your spouse

- CBIC gives effect to the provisions for furnishing nil return in FORM GSTR-3B by SMS

The post Statutory Compliance calender June 2020 appeared first on Studycafe.

from Studycafe https://ift.tt/3d0KTjx

No comments:

Post a Comment