Tax additions deleted as no difference was found in physical inventory inspected during survey

IN THE INCOME TAX APPELLATE TRIBUNAL

The Relevant Text of the Order as follows :

15. From the record we found that addition was made on the basis of statement of Director. However, later on the director retracted his statements. The assessee company with the help of complete working established that the statements at the time of survey with regard to processing cost was wrong. However, A.O. could not point out any defect or discrepancy in factual working so submitted and which were duly supported by audited accounts. The A.O. solely relied only on the statements to make the additions and had no other evidence. Thus there is no merit for the addition made on account of processing rate difference in so far as all processes as envisaged by the department were not carried out on all the finished goods and only the process required by the customers were so carried out. Therefore, actual process cost as arrived in books of account is to be taken for valuation of stock.

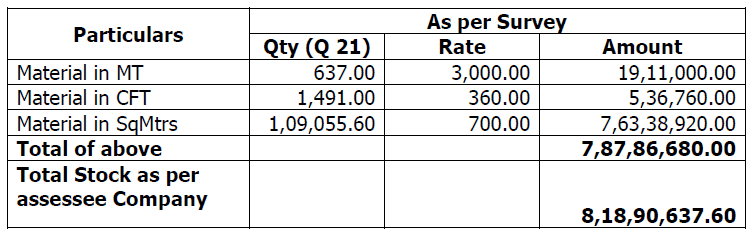

16. Even if the said difference in the physical quantity so taken by the department is accepted the resultant valuation (as per the rates adopted by the assessee company) will be as under:

17. It is clear from the above chart that even if the tentative quantity taken by the department with the rates as per books of account is taken total stock works out at Rs. 7,87,86,680/- as against the stock as per books of account at Rs. 8,18,90,637/-. Thus, there is shortage of stock as on the date of survey amounting to Rs. 31,03,957/- which can be considered as having been sold but not recorded in the books of account on the date of survey. At the most, the department can add GP earned on such shortage of stock, in so far as the A.O. has not doubted that all the purchases had been recorded in the books of account. Once the purchases is found to be accounted for, addition can be made with respect to G.P. earned on such shortage of stock. The G.P. during the year is 7.48%. Applying the same to the shortage of stock amounting to Rs. 31,03,957/- gives a profit of Rs. 2,32,175/-. Accordingly, we uphold the addition of Rs. 2,32,175/-. The A.O. is directed accordingly.

18. In the result, appeal of the assessee is allowed in part.

Order pronounced in the open court on 11th April, 2019.

Tags: Judgement, Appellant Tribunal, Income Tax

The post Tax additions deleted as no difference was found in physical inventory inspected during survey appeared first on Studycafe.

from Studycafe https://ift.tt/2AEMG0b

No comments:

Post a Comment