Banking company can avail ITC on the premium paid to DICGC

THE AUTHORITY OF ADVANCE RULING

The Question and Ruling as follows:

The applicant is engaged in the business of banking as a Regional Rural Bank. It accepts deposits from its customers. It is statutorily required to pay a premium to Deposit Insurance and Credit Guarantee Corporation (In short “DICGC) on these deposits, on which GST is collected by the DICGC. Now the bank is availing and intends to continue to avail credit of GST paid, as prescribed under respective GST Acts, as it is an inward supply for its banking business. To avoid any future litigation, the bank now seeks advance ruling, whether input credit of GST on this inward supply is just and proper under the GST law?

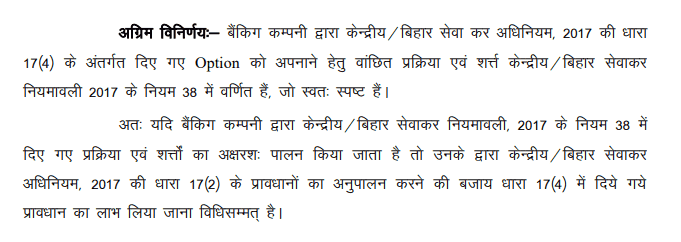

RULING

Tags: Judgement, GST, Advance Ruling

You May Also Like :

- Failed to file TRANS-1

- Goods detained released on giving Bank Guarantee: HC

- HSN code applicable for the material ‘Heat Activated Ultra-Violet (HAUV) Polyester Film’ under GST

- Design & Development services provided by Indian companies abroad is Export of service or OIDAR services?

The post Banking company can avail ITC on the premium paid to DICGC appeared first on Studycafe.

from Studycafe https://ift.tt/32pd1Lu

No comments:

Post a Comment