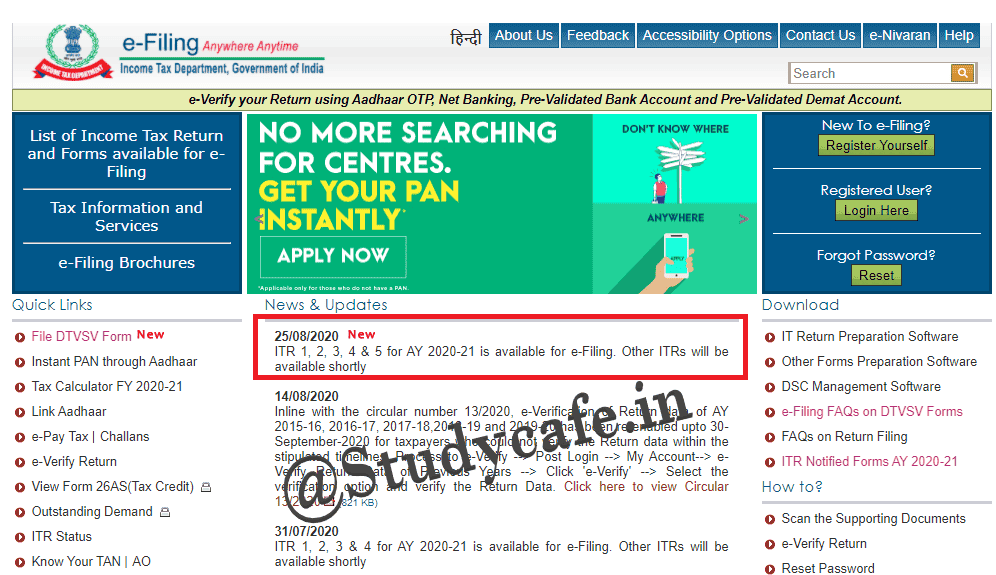

ITR-5 is now available on Income Tax portal

ITR 5 is meant for firms, LLPs, AOPs (Association of persons) and BOIs (Body of Individuals), Artificial Juridical Person (AJP), Estate of deceased, Estate of insolvent, Business trust and investment fund.

ITR 5 Form can be used by Firms, Limited Liability Partnerships (LLPs), Association of Persons(AOP) and Body of Individuals (BOIS), Artificial Juridical Person, Cooperative society and Loc, subject to the condition that they do not need to file the return of income under section 139(4A) or 139(4B) or 139(4C) or 139(4D) (i.e., Trusts, Political party, Institutions, Colleges, etc.). Individuals, HUFs (Hindu Undivided Families), Companies are not eligible to use the ITR 5 Form.

ITR 5 is now available on Income Tax portal for e-filing.

Click Here to Download ITR-5 Excel Utility

Tags: Income Tax

You May Also Like :

- Scanned Form 35A can be filed to meet deadline for filing objections – ITAT

- TDS- For the purpose of computation of interest expression month is to be interpreted as period of 30 days

- Business expenditure, Year of allowability of expenditure

The post ITR-5 is now available on Income Tax portal appeared first on Studycafe.

from Studycafe https://ift.tt/31BbMYS

No comments:

Post a Comment