GST PMT-06 Challan for making payment under QRMP Scheme

GST PMT- Challan has gained wide importance these days, especially after the introduction of the QRMP Scheme. Through this article let us understand all about the Form.

What is GST PMT-06?

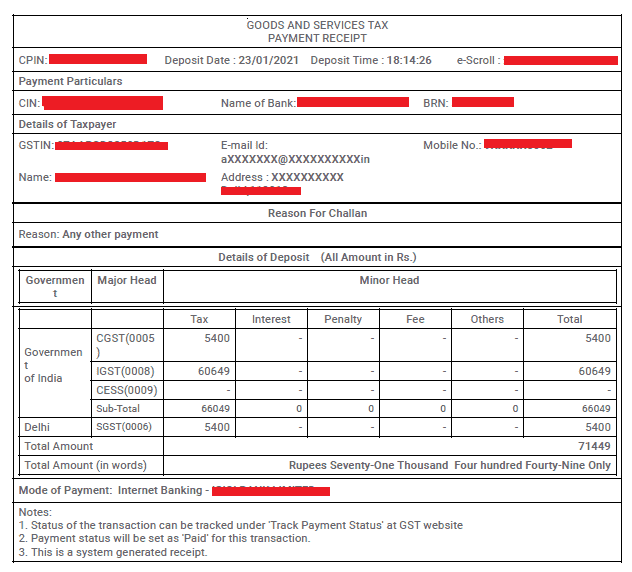

A taxpayer who wants to deposit tax, interest, penalty, fees or any other amount shall generate a challan in FORM GST PMT-06 on the common portal and enter the details of the amount to be deposited by him.

This is not a new concept. This is the same old challan we have been using to pay tax while filing GSTR-3B. Only the FORM GST PMT-06 has come into more notice amid QRMP Scheme.

How to Access the GST PMT-06 Challan?

- Go to Services Tab

- Click on Payments

- Click on Create Challan

What has changed in GST PMT-06 due to QRMP Scheme?

As such, there is no change in the particulars of the Challan Form. But yes, while generating the Challan Form we need to follow a specific process. The same is given below for reference:

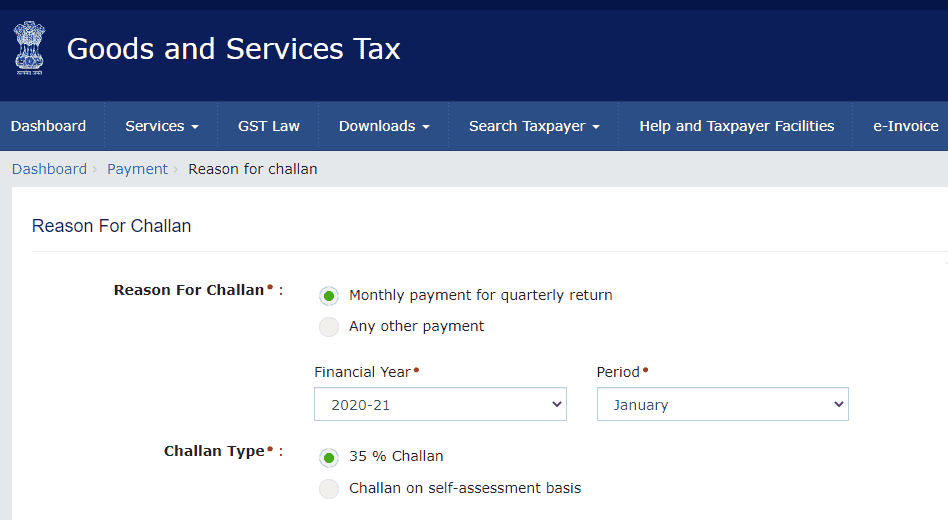

While generating the Challan Taxpayer needs to provide the Specific Reason for making the payment. The Reson can be:

- Monthly Payment for Quarterly Return; In case you are making payment under QRMP Scheme

- Any other payment

Monthly Payment for Quarterly Return will further be followed by:

- 35% Challan

- Challan on a self-assessment basis

Which reason should be selected by the Taxpayer while making payment through Challan GST PMT-06?

Option 1: Monthly Payment for Quarterly Return

This option will be selected by the taxpayer filing GSTR-3B on quarterly basis and intending to make payment for the first and second months of the quarter.

- 35% Challan should be selected when you are making payment through Fixed Sum Method

- Challan on a self-assessment basis should be selected if you are self-assessing your tax.

Please note that in the third month, the payment of Tax Liability will be Automatically routed to GST-PMT-06 Challan though Form-GSTR-3B. So Taxpayer is not required to select a specific option in 3rd Month. But if the taxpayer is generating challan manually in 3rd month, he has to choose Any other payment Option.

Option 2: Any other payment

A taxpayer who is not Filing returns under QRMP Scheme shall choose Any other payment option for making Tax Payment.

The following has been discussed in Brief:

| Taxpayer | Challan Option | ||

| M1 | M2 | M3 | |

| QRMP Opted | Monthly Payment for Quarterly Return | Monthly Payment for Quarterly Return | Any other payment |

| QRMP Not Opted | Any other payment | Any other payment | Any other payment |

What are the Due Dates for making Payment of GST Output Liability?

| Taxpayer | M1 | M2 | M3 |

| QRMP Opted | 25th of next Month | 25th of next Month | 22nd/or 24th as per your Place of Bussiness |

| QRMP Not Opted | 20th of next Month | 20th of next Month | 20th of next Month |

How to Calculate Outstanding Tax Liability for Taxpayers under QRMP Scheme and otherwise?

| Taxpayer | M1 | M2 | M3 | ||

| QRMP Opted | 35% Payment Option | If RP was a Quarterly Filler | 35% of Tax paid in cash in Previous Quarter | 35% of Tax paid in cash in Previous Quarter | Actual Liability via GSTR-3B |

| If RP was a Monthly Filler | 100% of Tax paid in cash in Previous month | 100% of Tax paid in cash in Previous month | Actual Liability via GSTR-3B | ||

| Self Assessment | Self Assessed Tax | Self Assessed Tax | Actual Liability via GSTR-3B | ||

| QRMP Not Opted | Actual Liability via GSTR-3B | Actual Liability via GSTR-3B | Actual Liability via GSTR-3B | ||

The Tax liability will be reduced by the amount present in the Cash and credit ledger of the taxpayer.

Please note the below-mentioned Scenario for Better understanding:

| Senarios | Taxpayer | Tax Liability to be discharged by GST PMT-09 | ||

| M1 | M2 | |||

| 1 | Nil Liability | 35% Payment Option | NA | NA |

| Self Assessment | NA | NA | ||

| 2 | Adequate Cash/ Credit Balance | 35% Payment Option | NA | NA |

| Self Assessment | NA | NA | ||

| 3 | Adequate Cash/ Credit Balance in M1 but not in M2 | 35% Payment Option | NA | Auto-Generated Challan |

| Self Assessment | NA | Self Assessed Amount | ||

| 4 | Inadequate Cash/ Credit Balance | 35% Payment Option | Auto-Generated Challan | Auto-Generated Challan |

| Self Assessment | Self Assessed Amount | Self Assessed Amount | ||

Please note that in the 3rd Scenario, the Taxpayer can choose a payment option in M2 as in M1 he was not required to make any tax payment, thus the question of choosing a payment option did not arise.

What is the Late Fees Applicable on delayed Filing of Form GST PMT-06?

No Late Fees is applicable on delayed Filing of Form GST PMT-06.

What is the interest Applicable on delayed payment/short payment of taxes via Form GST PMT-06?

- Delayed Filing of Form GST PMT-06

It means delayed payment of Taxes. Yes, interest is applicable u/s 50 on delayed Filing of Form GST PMT-06. The Rate of Interest is 18% pa.

For Example, interest is applicable when Tax is paid after the due date of 25th in case you have opted for QRMP Scheme.

- Interest Short Payment of Taxes

35% Payment Option or Fixed Sum Method

No Interest is applicable if the taxpayer makes payment as per pre-filled challan and discharges remaining tax liability on due date of filing GSTR-3B.

Self Assessment Method

Interest is applicable if the taxpayer makes payment as per the self-assessment method and discharges the remaining tax liability after the due date.

Discussion Point:

Some clarification is still pending that what will happen is the taxpayer chooses wrong payment Option for making Tax.

from Studycafe https://ift.tt/2MlaR9V

No comments:

Post a Comment