GST QRMP vs Non-QRMP Brief Analysis

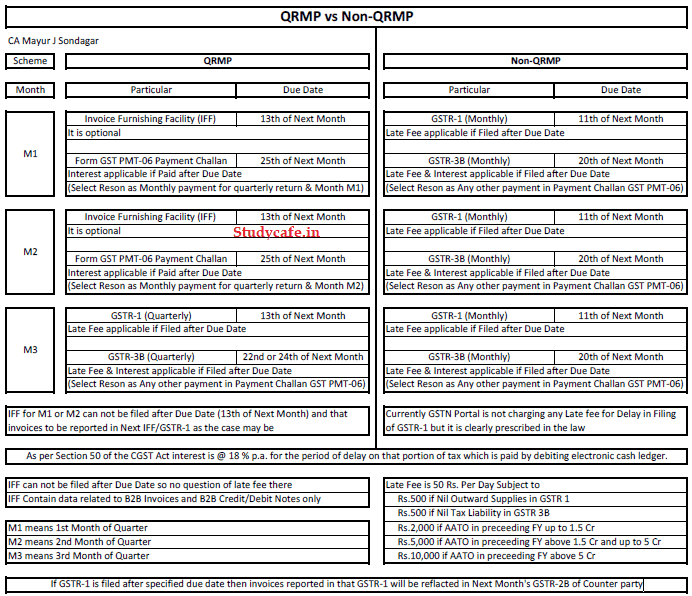

Below is the crisp analysis between Quarterly Return Monthly Payment [QRMP] Scheme and Regular GSTR-3B Filing Scheme which will help you in deciding while choosing b/w QRMP or Non-QRMP Scheme.

| QRMP vs Non-QRMP | ||||

| Scheme | QRMP | Non-QRMP | ||

| Month | Particular | Due Date | Particular | Due Date |

| M1 | Invoice Furnishing Facility (IFF)- Optional | 13th of Next Month | GSTR-1 (Monthly)- Late Fee applicable if Filed after Due Date | 11th of Next Month |

| Form GST PMT-06 Payment Challan | 25th of Next Month | GSTR-3B (Monthly) | 20th of Next Month | |

| Interest applicable if Paid after Due Date | Late Fee & Interest applicable if Filed after Due Date | |||

| (Select Reson as Monthly payment for quarterly return & Month M1) | (Select Reson as Any other payment in Payment Challan GST PMT-06) | |||

| M2 | Invoice Furnishing Facility (IFF) | 13th of Next Month | GSTR-1 (Monthly) | 11th of Next Month |

| It is optional | Late Fee applicable if Filed after Due Date | |||

| Form GST PMT-06 Payment Challan | 25th of Next Month | GSTR-3B (Monthly) | 20th of Next Month | |

| Interest applicable if Paid after Due Date | Late Fee & Interest applicable if Filed after Due Date | |||

| (Select Reson as Monthly payment for quarterly return & Month M2) | (Select Reson as Any other payment in Payment Challan GST PMT-06) | |||

| M3 | Invoice Furnishing Facility (IFF) | 13th of Next Month | GSTR-1 (Monthly) | 11th of Next Month |

| It is optional | Late Fee applicable if Filed after Due Date | |||

| GSTR-3B (Monthly) | 22nd or 24th of Next Month | GSTR-3B (Monthly) | 20th of Next Month | |

| Late Fee & Interest applicable if Filed after Due Date | Late Fee & Interest applicable if Filed after Due Date | |||

| (Select Reson as Any other payment in Payment Challan GST PMT-06) | (Select Reson as Any other payment in Payment Challan GST PMT-06) | |||

GST QRMP vs Non-QRMP Brief Analysis

Notes:

- IFF for M1 or M2 can not be filed after Due Date (13th of Next Month) and that invoices to be reported in Next IFF/GSTR-1 as the case may be

- Currently GSTN Portal is not charging any Late fee for Delay in Filing of GSTR-1 but it is clearly prescribed in the law

- As per Section 50 of the CGST Act interest is @ 18 % p.a. for the period of delay on that portion of tax which is paid by debiting electronic cash ledger.

- IFF Contain data related to B2B Invoices and B2B Credit/Debit Notes only

- The late Fee is 50 Rs. Per Day Subject to

- Rs.500 if Nil Outward Supplies in GSTR 1

- Rs.500 if Nil Tax Liability in GSTR 3B

- Rs.2,000 if AATO in preceding FY up to 1.5 Cr

- Rs.5,000 if AATO in preceding FY above 1.5 Cr and up to 5 Cr

- Rs.10,000 if AATO in preceding FY above 5 Cr

- Please also note that:

- M1 means 1st Month of Quarter

- M2 means 2nd Month of Quarter

- M3 means 3rd Month of Quarter

- If GSTR-1 is filed after specified due date then invoices reported in that GSTR-1 will be reflected in Next Month’s GSTR-2B of Counter party

from Studycafe https://ift.tt/3iMXXxM

No comments:

Post a Comment