How to download 26AS from Traces

These days Taxpayers are are facing difficulty in Downloading Form 26AS from the Income tax Site. Also in case size of your 26AS is large, you need to download it directly from Traces. Please note that you can download the same from Traces portal directly. In this article steps for downloading 26AS from Traces Directly are given.

Please note that you need to use your PAN login for the same.

How to create PAN Login on Traces?

Please note that not everyone can have a PAN login as it is generally created when you do transactions like Depositing TDS on Immovable Property etc. Otherwise, you need Aadhar Authentification for creating a Login. Steps are discussed in the Article.

1. Register on Traces as a “Tax-Payer”

2. Please Fill in Required Details like PAN, DOB, and Name:

Now, this is a bit Technical Step:

You can use 4 Options for Creating Login:

Option 1-Details of TDS/TCS Deposited

Option 2- Challan Details of Tax Deposited by Taxpayer ( i.e. Advance Tax, Self Assessment Tax, TDS on Property and TDS on Rent )

In case you’ve deposited challan recently, please try registration after 3 working days from Date of Challan Deposit.

Option 3-Mention Details of 26QB statement details filed by Buyer before correction

Option 4- Authentication through Aadhaar / VID

You Aadhaar should be linked with your Mobile/Email to proceed Authentication through Aadhaar / VID

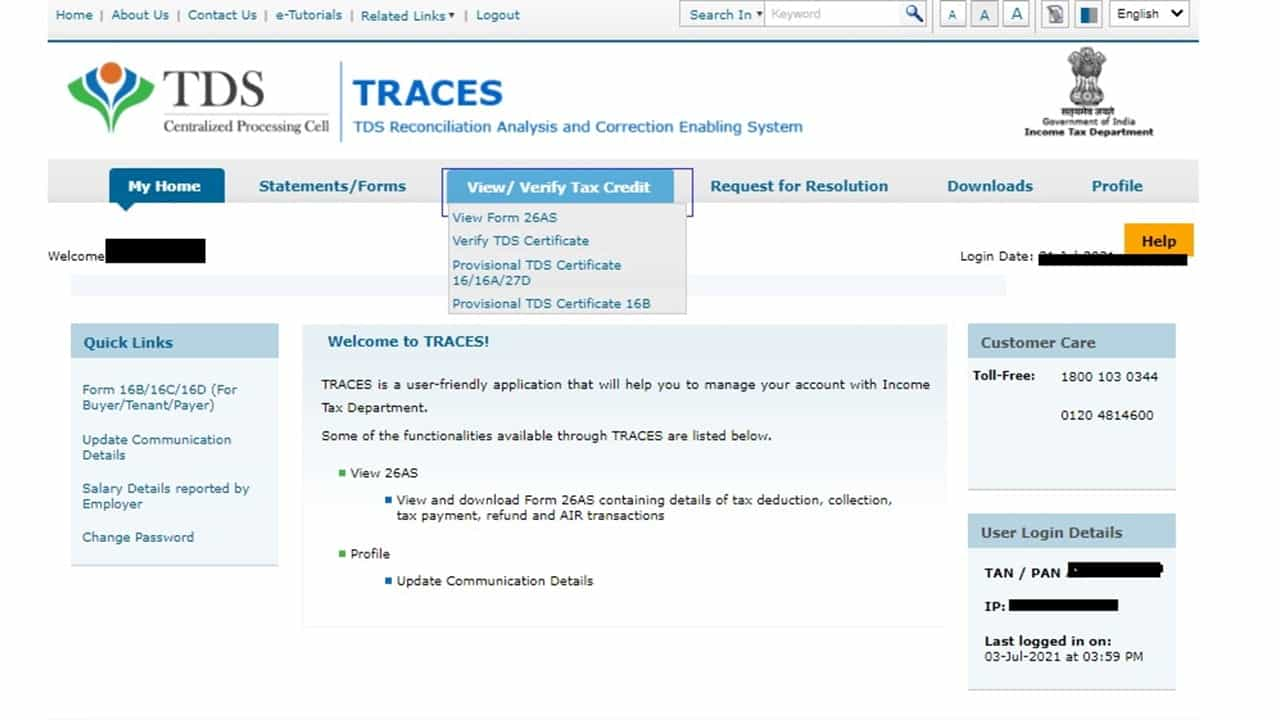

Once your registration is complete, 26As can be downloaded as per the below-mentioned image:

from Studycafe https://ift.tt/3rmTW76

No comments:

Post a Comment