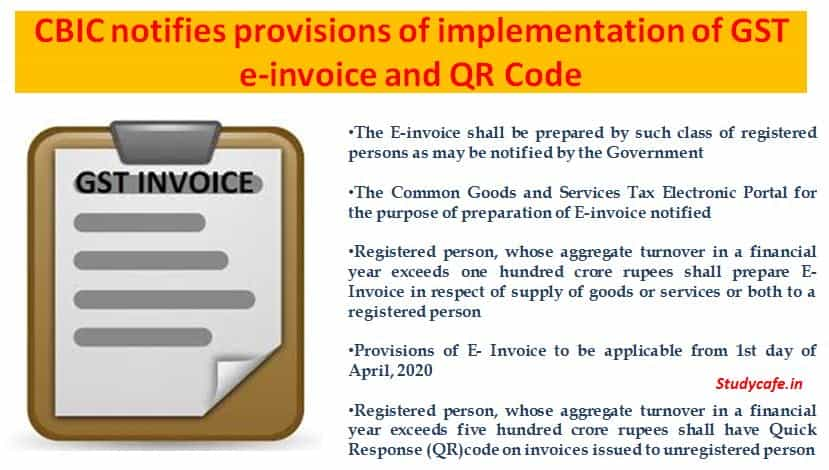

CBIC notifies provisions of implementation of GST e-invoice and QR Code

As per new provisions notified by CBIC, B2B invoices to be E-Invoices and B2C invoices to have QR Code.

To make these changes CBIC issued five Central Tax notifications on 13.12.2019 i.e. Notification No. 68/2019–Central Tax to Notification No. 72/2019–Central Tax.

The Notifications are as follows:

| Notifications | Subject |

| 72/2019-Central Tax ,dt. 13-12-2019 | Seeks to notify the class of registered person required to issue invoice having QR Code. |

| 71/2019-Central Tax ,dt. 13-12-2019 | Seeks to give effect to the provisions of rule 46 of the CGST Rules, 2017. |

| 70/2019-Central Tax ,dt. 13-12-2019 | Seeks to notify the class of registered person required to issue e-invoice. |

| 69/2019-Central Tax ,dt. 13-12-2019 | Seeks to notify the common portal for the purpose of e-invoice. |

| 68/2019-Central Tax ,dt. 13-12-2019 | Seeks to carry out changes in the CGST Rules, 2017. |

Summary of these notifications are as follows:

Notification No. 68/2019 – Central Tax ,dt. 13-12-2019

- The E-invoice shall be prepared by such class of registered persons as may be notified by the Government

- It will be prepared in FORM GST INV-01

- Tax payer is required to obtain an Invoice Reference Number by uploading information contained therein on the Common Goods and Services Tax Electronic Portal.

Notification No. 69/2019-Central Tax ,dt. 13-12-2019

The Common Goods and Services Tax Electronic Portal for the purpose of preparation of E-invoice are:-

(i) https://ift.tt/2Pk17eH;

(ii) https://ift.tt/2rObRJx;

(iii)https://ift.tt/35kWSFf;

(iv) https://ift.tt/2rK4liL;

(v) https://ift.tt/2PETLl6;

(vi) https://ift.tt/38GlT02;

(vii) https://ift.tt/2RWY5ia;

(viii) https://ift.tt/34hl5LC;

(ix) https://ift.tt/36ACmkp;

(x) https://ift.tt/2RQFUux.

The above mentioned websites will be managed by the Goods and Services Tax Network.

Notification No. : 70/2019-Central Tax ,dt. 13-12-2019 ,dt. 13-12-2019

Registered person, whose aggregate turnover in a financial year exceeds one hundred crore rupees shall prepare E-Invoice in respect of supply of goods or services or both to a registered person

Notification No. : 71/2019-Central Tax ,dt. 13-12-2019 ,dt. 13-12-2019

Provisions of E- Invoice to be applicable from 1st day of April, 2020

Notification No. : 72/2019-Central Tax ,dt. 13-12-2019

Registered person, whose aggregate turnover in a financial year exceeds five hundred crore rupees shall have Quick Response (QR)code on invoices issued to unregistered person

Tags : GST, GST Notifications

For Regular Updates Join : https://t.me/Studycafe

The post CBIC notifies provisions of implementation of GST e-invoice and QR Code appeared first on Studycafe.

from Studycafe https://ift.tt/34lWqFu

No comments:

Post a Comment