TDS on Purchase & TCS on Sale explained with charts and Tally Entry

Understanding Compliance:

From Seller Side

| 1 | If Sale Receipts Above 50 lakh | If Buyer is not liable to Deduct TDS u/s 194Q then TCS u/s 206C(1H) @ 0.1 % on Receipts Above 50 lakh |

| If Buyer is liable to Deduct TDS under any other provision of this Act and has deducted such amount then No TCS u/s 206C(1H) | ||

| If Buyer is liable to Deduct TDS under any other provision of this Act and has not deducted such amount then TCS u/s 206C(1H) @ 0.1 % on Receipts Above 50 lakh | ||

| 2 | If Sale Receipts upto 50 lakh | No TCS u/s 206(1H) |

TDS on Purchase & TCS on Sale explained with charts and Tally Entry

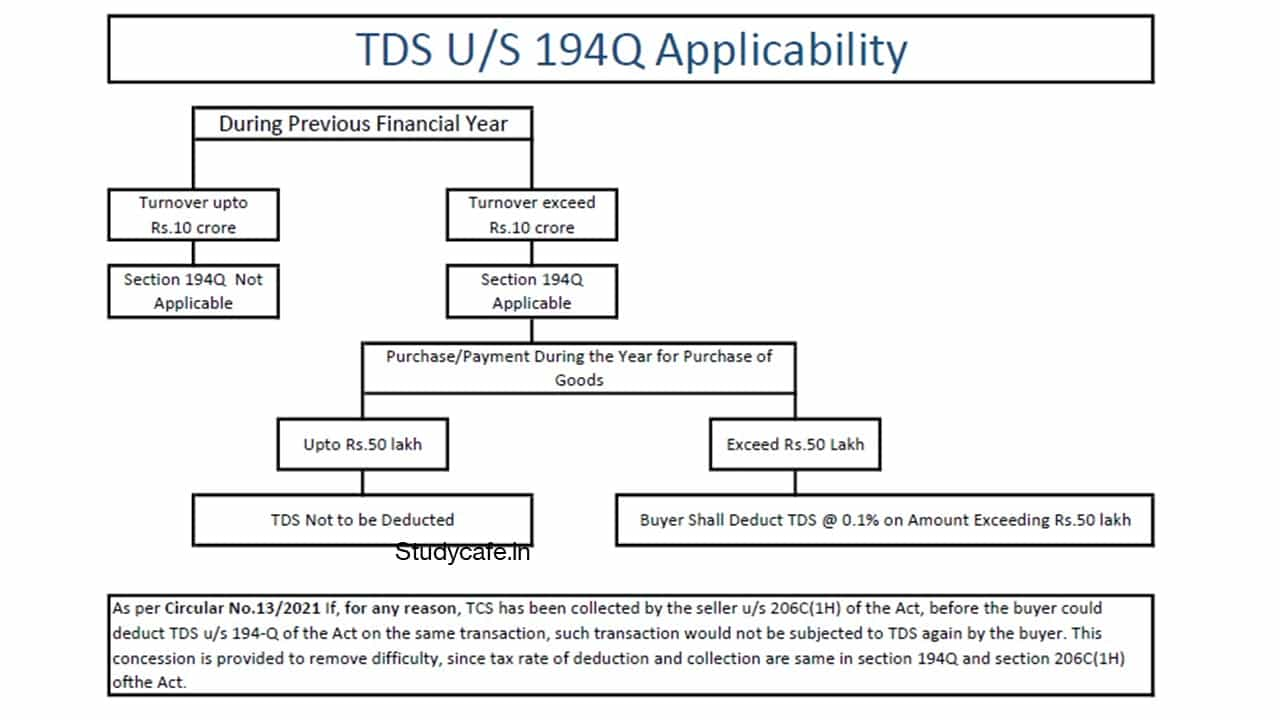

From Buyer Side

| 1 | If Purchase Value Above 50 lakh | Deduction TDS u/s 194Q @ 0.1 % on Value Above 50 lakh |

| 2 | If Purchase Value upto 50 lakh | No TDS u/s 194Q but TCS u/s 206(1H) may be applicable if aggregate payment (Including last year due) exceed 50 lakh during the year |

Let’s Have some Examples

| Seller’s Turnover (Cr) | Buyer’s Turnover (Cr) | Transaction Value (Lakh) | Receipt (Lakh) | Section Applicable |

Reason |

| 13.00 | 12.00 | 60.00 | 60.00 | 194Q – TDS | No TCS as TDS applied |

| 8.00 | 12.00 | 60.00 | 60.00 | 194Q – TDS | Buyer’s Turnover Above 10 Cr |

| 13.00 | 7.00 | 60.00 | 60.00 | 206C(1H) – TCS | Seller’s Turnover Above 10 Cr |

| 8.00 | 7.00 | 60.00 | 60.00 | No TDS/TCS | Turnover upto 10 Cr |

| 13.00 | 12.00 | 45.00 | 45.00 | No TDS/TCS | Transaction Value upto 50 Lakh |

| 13.00 | 7.00 | 45.00 | 60.00 | 206C(1H) – TCS | Receipts Above 50 Lakh |

| 8.00 | 12.00 | 45.00 | 60.00 | No TDS | Transaction Value upto 50 Lakh |

| 13.00 | 7.00 | 60.00 | 45.00 | No TCS | Receipts upto 50 Lakh |

Short Summary:

| Particular | SECTION 194Q | SECTION 206C(1H) |

| Tax | TDS | TCS |

| Applicable to | Buyer | Seller |

| Applicable on | Purchase of Goods | Sale of Goods |

| Turnover Limit of Previous F.Y. | 10 Crore | 10 Crore |

| Threshold Limit | 50 Lakh | 50 Lakh |

| Normal Rate | 0.1% | 0.1% |

| Rate Without PAN | 5.0% | 1.0% |

| Time of Deduction/Collection | Payment or Credit whichever is earlier | At the time of Receipt |

| Deposit Date | 7th of Next Month | 7th of Next Month |

| TDS Return Form | Form 26Q | Form 27EQ |

Accounting Entries For TCS u/s 206C(1H) & TDS u/s 194Q

For Seller if he is liable to Collect TCS & Buyer have not Deducted TDS

| S.No. | Transaction Type | Particular | Debit | Credit |

| ENTRY NO. 1 | At the time of Booking Sale Transaction | Sundry Debtors | 1,05,000.00 | |

| To Sale | 1,00,000.00 | |||

| To GST | 5,000.00 | |||

| ENTRY NO. 2 | On Receipt of Sale Proceeds from Debtors | Bank A/c | 1,05,000.00 | |

| To Sundry Debtors | 1,05,000.00 | |||

| ENTRY NO. 3 | Provision for TCS Liability on Date of Receiving Sale Proceeds | Sundry Debtors | 105 | |

| To TCS Payable | 105 | |||

| ENTRY NO. 4 | On Payment of TCS on 7th of Next Month | TCS Payable | 105 | |

| To Bank A/c | 105 |

For Buyer if Seller have Collected TCS (Buyer is not liable to Deduct TDS)

| S.No. | Transaction Type | Particular | Debit | Credit |

| ENTRY NO. 1 | At the time of Booking Purchase Transaction | Purchase | 1,00,000.00 | |

| GST | 5,000.00 | |||

| To Sundry Creditors | 1,05,000.00 | |||

| ENTRY NO. 2 | On Payment to Sundry Creditors | Sundry Creditors | 1,05,000.00 | |

| To Bank A/c | 1,05,000.00 | |||

| ENTRY NO. 3 | On Receipt of Debit note from Creditors | TCS Receivable | 105 | |

| To Sundry Creditors | 105 | |||

| ENTRY NO. 4 | On Payment of TCS to Sundry Creditors | Sundry Creditors | 105 | |

| To Bank A/c | 105 |

For Seller if Buyer have Deducted TDS (Seller Shall not to Collect TCS)

| S.No. | Transaction Type | Particular | Debit | Credit |

| ENTRY NO. 1 | At the time of Booking Sale Transaction | Sundry Debtors | 1,05,000.00 | |

| To Sale | 1,00,000.00 | |||

| To GST | 5,000.00 | |||

| ENTRY NO. 2 | Receipt of Sale Proceeds from Debtors | Bank A/c | 1,04,900.00 | |

| To Sundry Debtors | 1,04,900.00 | |||

| ENTRY NO. 3 | Entry of TDS Receivable on date of Receipt from Debtors | TDS Receivable | 100 | |

| To Sundry Debtors | 100 |

For Buyer if he is liable to Deduct TDS

| S.No. | Transaction Type | Particular | Debit | Credit |

| ENTRY NO. 1 | At the time of Booking Purchase Transaction | Purchase | 1,00,000.00 | |

| GST | 5,000.00 | |||

| To Sundry Creditors | 1,04,900.00 | |||

| To TDS Payable | 100 | |||

| ENTRY NO. 2 | On Payment of TDS on 7th of Next Month | TDS Payable | 100 | |

| To Bank A/c | 100 |

*Assumed GST Rate at 5 % / TCS Rate at 0.1 % / TDS Rate at 0.1 % / Threshold Limit of Rs.50 Lakh was crossed

*TCS to be Collected on Total Amount including GST

*TDS to be Deducted on Amount excluding GST & Purchase Return

from Studycafe https://ift.tt/3yqWinK

No comments:

Post a Comment